Understanding Balance Transfer Basics: How It Works And When To Use It

Are you struggling to pay off your credit card debt? If so, a balance transfer could be just what you need. By transferring your balance to a new credit card with a lower interest rate, you could save money and pay off your debt faster. But how does it work, and when should you use it? In this article, we’ll explore the basics of balance transfers and help you determine if it’s the right choice for you.

A balance transfer is when you move high-interest debt from one credit card to another with a lower interest rate. It can help you save money on interest and pay off your debt faster. However, it’s important to understand the fees and terms of the new card, as well as to make a plan to pay off the transferred balance before the introductory rate expires. Consider a balance transfer if you have a good credit score and a plan to pay off the balance within the introductory period.

Understanding Balance Transfer Basics: How It Works and When to Use It

If you have credit card debt with high-interest rates, balance transfer can be a great option to save money. A balance transfer involves moving your credit card balances from one or more credit cards to another credit card with a lower interest rate. In this article, we will discuss the basics of balance transfer, how it works, and when to use it.

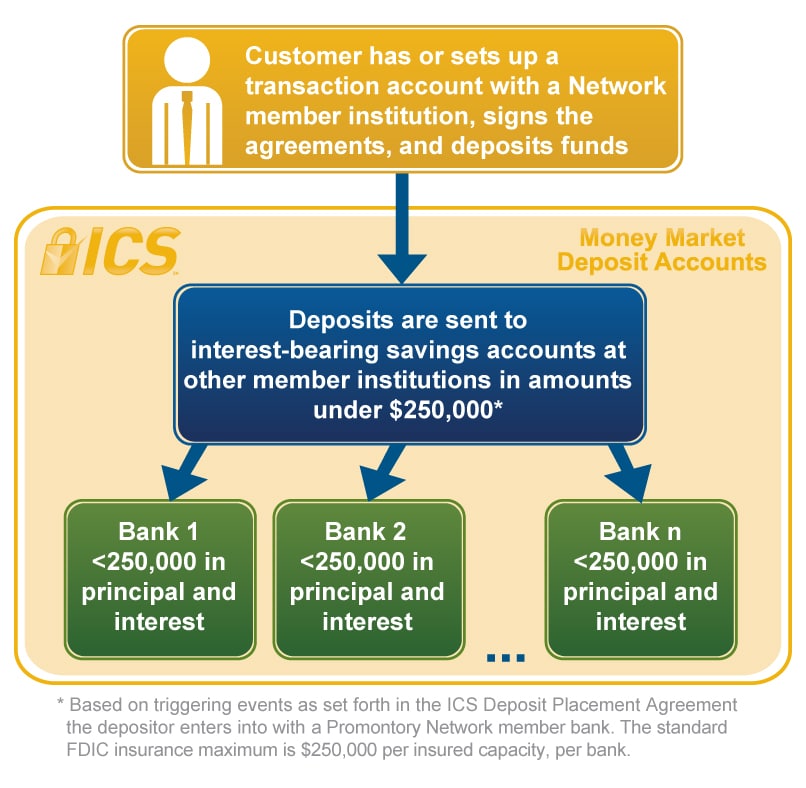

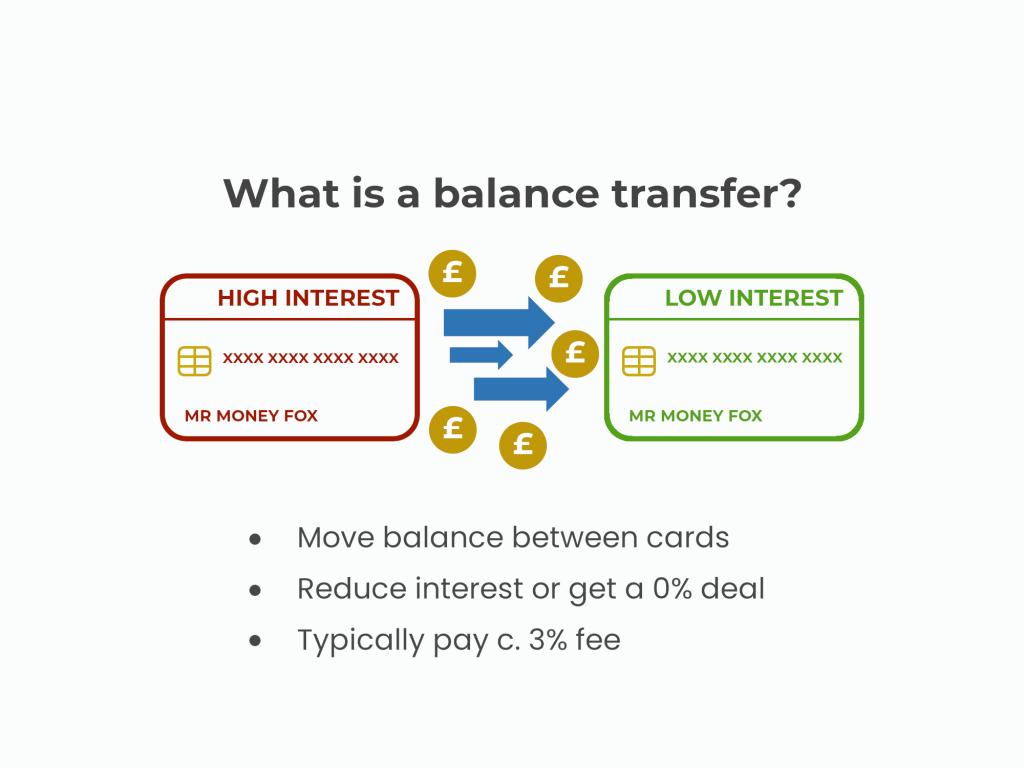

What is a Balance Transfer?

A balance transfer is the process of transferring debt from one credit card to another. The balance transfer is done to take advantage of a lower interest rate on the new credit card. Most credit card companies offer balance transfer options, and they usually come with a promotional interest rate that is lower than the regular interest rate. The promotional rate is usually valid for a specific period, after which the regular interest rate will apply.

How Does It Work?

When you transfer a balance, you are moving the balance from one credit card to another. The balance is transferred electronically, and the process usually takes a few days to complete. Once the balance is transferred, you will start paying the promotional interest rate on the new credit card. It is important to note that there is usually a balance transfer fee, which is a percentage of the amount transferred. The fee can range from 3% to 5% of the balance transferred.

When to Use Balance Transfer?

A balance transfer can be used to save money on high-interest credit card debt. If you have multiple credit cards with high-interest rates, you can transfer the balances to a new credit card with a lower interest rate. This will help you save money on interest charges and pay off your debt faster. However, balance transfer is not a one-size-fits-all solution. It is important to consider the following factors before using a balance transfer:

1. Credit Score: To qualify for a balance transfer, you need to have a good credit score. Most credit card companies require a credit score of 670 or higher.

2. Promotion Period: The promotional period is the period during which you will pay a lower interest rate. It is important to know the length of the promotion period and make sure you can pay off your balance before the promotional period ends.

3. Balance Transfer Fee: As mentioned earlier, there is usually a balance transfer fee. It is important to consider the fee and make sure it is worth the savings in interest charges.

4. New Interest Rate: After the promotional period ends, the regular interest rate will apply. It is important to know the regular interest rate and make sure it is lower than the interest rate on your current credit card.

Benefits of Balance Transfer

Balance transfer can help you save money on high-interest credit card debt. It can also help you pay off your debt faster by reducing the amount of interest charged. Here are some benefits of balance transfer:

1. Lower Interest Rate: Balance transfer offers a lower interest rate than most credit cards, which can save you money on interest charges.

2. Simplify Your Finances: If you have multiple credit cards with high-interest rates, balance transfer can help you consolidate your debt into one payment.

3. Pay off Debt Faster: By reducing the amount of interest charged, balance transfer can help you pay off your debt faster.

Balance Transfer Vs. Personal Loan

Balance transfer and personal loan are two options to consolidate debt. While they both offer a lower interest rate than most credit cards, there are some differences. Here are some differences between balance transfer and personal loan:

1. Interest Rate: Balance transfer offers a promotional interest rate, while personal loan offers a fixed interest rate.

2. Loan Amount: Personal loan allows you to consolidate a larger amount of debt than balance transfer.

3. Repayment Period: Personal loan offers a longer repayment period than balance transfer.

Conclusion

Balance transfer can be a great option to save money on high-interest credit card debt. However, it is important to consider the factors mentioned above before using a balance transfer. If you have a good credit score and can pay off your balance before the promotional period ends, balance transfer can help you save money and pay off your debt faster.

Frequently Asked Questions

What is a balance transfer and how does it work?

A balance transfer is the process of moving high-interest debt from one credit card to another with a lower interest rate. The goal is to save money on interest and pay off debt faster. When you transfer a balance, you’ll typically pay a fee of around 3-5% of the balance. However, many credit cards offer 0% interest for a promotional period, which can range from 6-18 months. During this time, you can focus on paying down your debt without accruing additional interest.

It’s important to note that not all credit cards are eligible for balance transfers, and some may have restrictions or limitations. Additionally, if you don’t pay off the balance before the promotional period ends, you may be subject to higher interest rates and fees.

When is it a good idea to use a balance transfer?

A balance transfer can be a good idea if you have high-interest credit card debt and are struggling to make payments. By transferring your balance to a card with a lower interest rate, you can save money on interest and pay off your debt faster. It’s also a good option if you have multiple credit card balances and want to consolidate them into one payment.

However, it’s important to consider the fees associated with a balance transfer and make sure the savings outweigh the cost. You should also have a plan in place to pay off the balance before the promotional period ends to avoid additional fees and interest. Additionally, if you have a low credit score or a lot of debt, you may not be eligible for a balance transfer.

What are the benefits of a balance transfer?

The main benefit of a balance transfer is the potential to save money on interest and pay off debt faster. By consolidating high-interest credit card balances onto a card with a lower interest rate, you can reduce the amount of interest you pay each month and put more money towards paying down your debt.

Additionally, a balance transfer can simplify your finances by consolidating multiple credit card balances into one payment. This can make it easier to keep track of your payments and stay on top of your debt.

What are the drawbacks of a balance transfer?

One drawback of a balance transfer is the fees associated with the process. Most credit cards charge a fee of around 3-5% of the balance to transfer, which can add up if you have a large balance. It’s important to weigh the cost of the fee against the potential savings on interest before deciding to transfer a balance.

Another drawback is the risk of not paying off the balance before the promotional period ends. If you don’t pay off the balance in full, you may be subject to higher interest rates and fees, which can undo any savings you gained from the transfer.

Can a balance transfer hurt my credit score?

A balance transfer can have a temporary negative impact on your credit score. When you apply for a new credit card, the lender will perform a hard inquiry on your credit report, which can lower your score by a few points. Additionally, if you close the credit card that you transferred the balance from, it can lower your overall credit utilization ratio, which can also lower your score.

However, if you make payments on time and pay off the balance before the promotional period ends, a balance transfer can actually help improve your credit score by reducing your debt-to-credit ratio. It’s important to be disciplined with your payments and avoid applying for multiple credit cards at once, which can have a more significant impact on your score.

In conclusion, understanding balance transfer basics can be a valuable tool for managing your debt. By transferring high-interest debt to a lower interest rate, you could save money and pay off your debt faster. However, it’s important to consider the fees and terms of the balance transfer offer before making a decision.

When considering a balance transfer, it’s important to have a plan in place for paying off the debt before the promotional period ends. This can help you avoid high interest rates and fees that could outweigh the benefits of the transfer.

Ultimately, balance transfers can be a useful strategy for those looking to manage their debt. However, it’s important to carefully consider the terms and fees before making a decision, and to have a plan in place for paying off the debt within the promotional period. With careful consideration and planning, a balance transfer could be the key to financial freedom.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)