The 9 Best Checking Accounts to Skyrocket Your Everyday Banking

Managing your finances is important, and having the right checking account can make all the difference. With so many options out there, it can be overwhelming to choose the right one for your needs. That’s why we’ve done the research and compiled a list of the top 9 best checking accounts for everyday banking.

Whether you’re looking for an account with no monthly fees, high-interest rates, or easy access to ATMs, we’ve got you covered. In this article, we’ll break down the features and benefits of each account so you can make an informed decision and find the perfect fit for your financial goals. So, let’s dive in and explore the best checking accounts on the market!

Here are the top 9 best checking accounts for everyday banking:

- Ally Bank

- Chase Total Checking

- Citibank

- Discover Cashback Debit

- Fidelity Cash Management Account

- PNC Virtual Wallet

- Schwab Bank High Yield Investor Checking

- Simple

- USAA Classic Checking

1. Chase Total Checking

Why We Like It: Chase Total Checking offers great sign-up bonuses and a vast network of ATMs and branches.

Who Should Get It: Anyone who wants a checking account with a large bank that has an extensive ATM and branch network.

- No monthly fee with a direct deposit or minimum balance

- $200 sign-up bonus

- 24/7 customer service

Pros:

- Large ATM and branch network

- No fee with a direct deposit or minimum balance

- Sign-up bonus

Cons:

- Low-interest rates

- Monthly fee without a direct deposit or minimum balance

2. Ally Interest Checking

Why We Like It: Ally Interest Checking provides high-interest rates and no monthly fees or minimum balance requirements.

Who Should Get It: Anyone who wants a checking account with no fees and high-interest rates.

- No monthly fees or minimum balance requirements

- No ATM fees at any ATM in the US

- 0.10% APY on balances under $15,000 and 0.50% APY on balances above $15,000

Pros:

- No fees or minimum balance requirements

- High-interest rates

- No ATM fees

Cons:

- No physical branches

- Out-of-network ATM fees

3. Capital One 360 Checking

Why We Like It: Capital One 360 Checking has no fees and offers high-interest rates.

Who Should Get It: Anyone who wants a checking account with no fees and high-interest rates.

- No monthly fees or minimum balance requirements

- No ATM fees at over 39,000 Capital One and Allpoint ATMs

- 0.20% APY on all balances

Pros:

- No fees or minimum balance requirements

- High-interest rates

- No ATM fees at Capital One and Allpoint ATMs

Cons:

- No physical branches

- Out-of-network ATM fees

4. USAA Classic Checking

Why We Like It: USAA Classic Checking has no monthly fees and offers ATM fee reimbursement.

Who Should Get It: Military members, veterans, and their families who want a checking account with no fees and ATM fee reimbursement.

- No monthly fees or minimum balance requirements

- ATM fee reimbursement upto $15 per month

- Mobile check deposit

Pros:

- No fees or minimum balance requirements

- ATM fee reimbursement

- Mobile check deposit

Cons:

- Membership eligibility requirements

- No physical branches

5. Discover Cashback Debit

Why We Like It: Discover Cashback Debit offers cashback rewards on debit card purchases.

Who Should Get It: Anyone who wants a checking account with cashback rewards on debit card purchases.

- No monthly fees or minimum balance requirements

- 1% cashback on up to $3,000 in debit card purchases per month

- No ATM fees at over 60,000 Allpoint ATMs

Pros:

- No fees or minimum balance requirements

- Cashback rewards on debit card purchases

- No ATM fees at Allpoint ATMs

Cons:

- Low-interest rates

- Out-of-network ATM fees

6. Schwab Bank High Yield Investor Checking

Why We Like It: Schwab Bank High Yield Investor Checking offers unlimited ATM fee reimbursement and no foreign transaction fees.

Who Should Get It: Frequent travelers who want a checking account with no ATM fees and no foreign transaction fees.

- No monthly fees or minimum balance requirements

- Unlimited ATM fee reimbursement

- No foreign transaction fees

Pros:

- No fees or minimum balance requirements

- Unlimited ATM fee reimbursement

- No foreign transaction fees

Cons:

- Requires a Schwab brokerage account

- Low-interest rates

7. TD Bank Convenience Checking

Why We Like It: TD Bank Convenience Checking offers a wide range of banking services and flexible account options.

Who Should Get It: Anyone who wants a checking account with a variety of banking services and flexible account options.

- No monthly fees with a minimum daily balance of $100

- Mobile banking and mobile deposit

- Overdraft protection options

Pros:

- Wide range of banking services

- Flexible account options

- Mobile banking and mobile deposit

Cons:

- Low-interest rates

- Monthly fee without a minimum daily balance of $100

8. Bank of America Advantage Plus Banking

Why We Like It: Bank of America Advantage Plus Banking offers a variety of banking services and relationship discounts.

Who Should Get It: Bank of America customers who want a checking account with a variety of banking services and relationship discounts.

- No monthly fees with a minimum daily balance of $1,500 or a direct deposit of $250

- Mobile banking and mobile deposit

- Relationship discounts on loans and credit cards

Pros:

- Wide range of banking services

- Relationship discounts

- Mobile banking and mobile deposit

Cons:

- Monthly fee without a minimum daily balance of $1,500 or a direct deposit of $250

- Low-interest rates

9. Wells Fargo Everyday Checking

Why We Like It: Wells Fargo Everyday Checking offers a wide range of banking services and a large ATM and branch network.

Who Should Get It: Anyone who wants a checking account with a large bank that has a wide range of banking services and a large ATM and branch network.

- No monthly fees with a minimum daily balance of $500 or a direct deposit of $500

- Mobile banking and mobile deposit

- Largest branch network in the US

Pros:

- Wide range of banking services

- Large ATM and branch network

- Mobile banking and mobile deposit

Cons:

- Monthly fee without a minimum daily balance of $500 or a direct deposit of $500

- Low-interest rates

Frequently Asked Questions

When it comes to everyday banking, choosing the right checking account is crucial. Here are some common questions about the top 9 best checking accounts for everyday banking:

1. What is the difference between a traditional and online checking account?

A traditional checking account is typically offered by brick-and-mortar banks, where you can walk into a branch and speak to a teller or banker. Online checking accounts, on the other hand, are offered by online banks that don’t have physical branches.

2. What are some fees to watch out for when choosing a checking account?

Some common fees associated with checking accounts include monthly maintenance fees, overdraft fees, ATM fees, and foreign transaction fees. Monthly maintenance fees can range from $5 to $15 and are typically waived if you meet certain account requirements such as maintaining a minimum balance or setting up direct deposit.

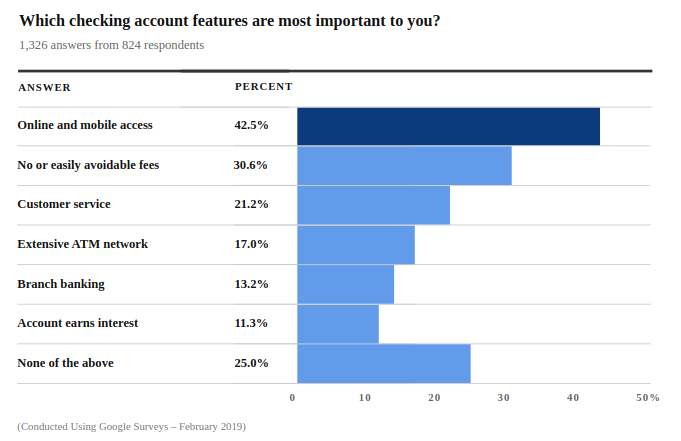

3. What features should I look for in a checking account?

When choosing a checking account, consider features such as low fees, high-interest rates, mobile banking, online bill pay, and overdraft protection. Low fees can save you money in the long run, while high-interest rates can help your money grow. Mobile banking and online bill pay can make banking more convenient, especially if you prefer managing your finances digitally. Overdraft protection can provide peace of mind and help you avoid costly overdraft fees.

4. How can I avoid overdraft fees?

To avoid overdraft fees, consider opting out of overdraft protection or linking a savings account for overdraft coverage. Another way to avoid overdraft fees is to set up alerts for low balances or account activity. Lastly, consider keeping a buffer in your checking account to avoid overdrafting in the first place.

Choosing the right checking account can make a significant difference in your everyday banking experience. With so many options available, it can be challenging to find the perfect fit. After extensive research and analysis, we have curated a list of the top 9 best checking accounts for everyday banking.

Finding the best checking account for your everyday banking needs is essential. With the options presented in this list, you can make an informed decision and choose a checking account that fits your lifestyle and financial goals. Don’t settle for a checking account that doesn’t meet your needs or charges excessive fees. Take the time to explore your options and select the best checking account for you. Click here if you want more information!