Top Ways To Boost Your Approval Odds For Credit Card Application

Are you tired of getting rejected for credit cards? Do you want to boost your chances of approval? Look no further because we have compiled the top ways to increase your approval odds for your credit card application.

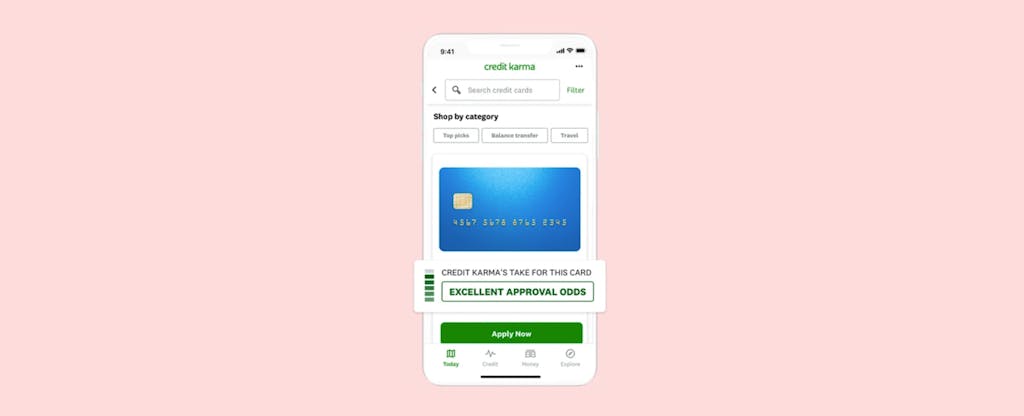

Firstly, knowing your credit score is crucial. By having a good credit score, you can show lenders that you are responsible with your finances. Secondly, make sure to only apply for cards that match your credit history. Applying for cards that require a higher credit score than you have can lead to rejection and hurt your credit score. Keep reading to discover more tips on how to boost your approval odds for credit card applications.

1. Check and improve your credit score.

2. Keep a stable income and employment history.

3. Limit your outstanding debts and credit applications.

4. Choose a card that matches your credit profile.

5. Provide accurate and complete information in your application.

6. Consider a secured credit card if you have a low credit score.

7. Apply for a card from a bank you already have a relationship with.

8. Consider a co-signer or authorized user to boost your chances.

Follow these tips to increase your chances of getting approved for a credit card.

Top Ways to Boost Your Approval Odds for Credit Card Application

A credit card is an essential tool for managing your finances, but not everyone is approved for one. If you’ve been denied a credit card, it can be discouraging, but don’t give up just yet. There are several ways to boost your approval odds for a credit card application. In this article, we’ll discuss the top ways to increase your chances of getting approved for a credit card.

1. Check Your Credit Report

Your credit score is one of the most critical factors that lenders consider when approving a credit card application. Before you apply for a credit card, it’s essential to check your credit report to ensure that there are no errors or inaccuracies. If you find any mistakes on your credit report, dispute them with the credit bureau to have them corrected.

It’s also a good idea to review your credit score and credit history to see where you stand. If your credit score is low, take steps to improve it before applying for a credit card. You can do this by paying down debt, making on-time payments, and keeping credit card balances low.

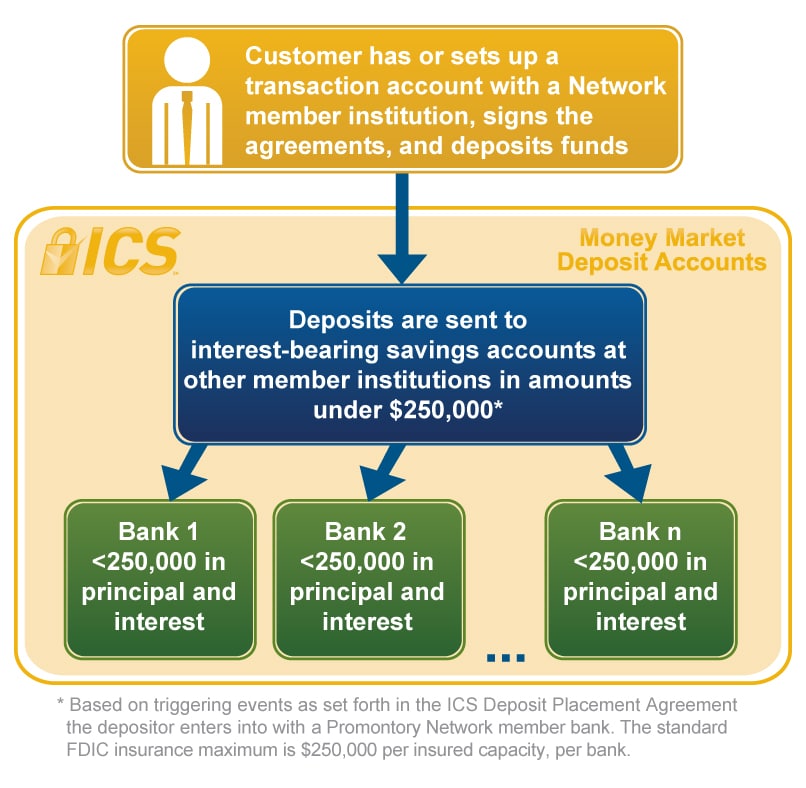

2. Choose the Right Card

Not all credit cards are created equal, and some are easier to get approved for than others. If you have a limited credit history or a low credit score, you may want to consider applying for a secured credit card. These cards require a deposit to secure your credit line, making them less risky for lenders.

You can also look for credit cards designed for people with limited credit history or those looking to build credit. These cards often have higher interest rates and lower credit limits, but they can be an excellent way to establish credit and improve your credit score.

3. Apply for the Right Card at the Right Time

Timing is everything when it comes to applying for a credit card. If you apply for too many credit cards at once, it can hurt your credit score and make you appear desperate for credit. On the other hand, if you wait too long between applications, lenders may think you’re not interested in credit.

It’s best to apply for a credit card when you have a stable income and a good credit score. Avoid applying for credit cards shortly after facing financial difficulties or during times of uncertainty, such as when you’re between jobs.

4. Provide Accurate Information

When you apply for a credit card, make sure you provide accurate information on your application. Lenders will verify the information you provide, so any discrepancies can hurt your chances of approval.

Make sure your name, address, and other personal information are correct. If you’re asked to provide income information, be honest and accurate. Lying on a credit card application is illegal and can result in a denial of your application.

5. Consider Adding a Co-Signer

If you’re struggling to get approved for a credit card on your own, you may want to consider adding a co-signer to your application. A co-signer is someone who agrees to take responsibility for your debt if you can’t pay it back.

Adding a co-signer can increase your chances of approval, especially if they have a good credit score and a stable income. However, keep in mind that if you don’t pay your credit card bills, it can hurt your co-signer’s credit score and finances.

6. Improve Your Debt-to-Income Ratio

Your debt-to-income ratio is the amount of debt you have compared to your income. Lenders consider this ratio when deciding whether to approve your credit card application. A high debt-to-income ratio can make it harder to get approved for a credit card.

To improve your debt-to-income ratio, focus on paying down debt and increasing your income. You can also consider consolidating your debt or taking out a personal loan to pay off high-interest credit card debt.

7. Limit Your Credit Card Applications

Applying for multiple credit cards at once can make you seem desperate for credit and hurt your credit score. It’s best to limit your credit card applications to one or two at a time.

Before you apply for a credit card, research the card’s requirements and make sure you meet them. Applying for a credit card you’re not qualified for can hurt your chances of approval.

8. Stay Current on Your Bills

One of the best ways to improve your credit score and increase your chances of approval for a credit card is to stay current on your bills. Make sure you pay all of your bills on time, including credit card bills, rent, utilities, and other expenses.

Late payments can hurt your credit score and make it harder to get approved for credit in the future. Set up automatic payments or reminders to ensure you never miss a payment.

9. Keep Your Credit Utilization Low

Your credit utilization is the amount of credit you’re using compared to your credit limit. Lenders consider this factor when deciding whether to approve your credit card application.

To improve your credit utilization, keep your credit card balances low and pay off your balances in full each month. You can also consider requesting a credit limit increase or opening a new credit card account to increase your available credit.

10. Monitor Your Credit Score and Report

Finally, it’s essential to monitor your credit score and report regularly. This will help you stay on top of any changes to your credit and identify any errors or inaccuracies that may be hurting your credit score.

You can monitor your credit score for free using online tools or by signing up for a credit monitoring service. If you notice any errors on your credit report, dispute them with the credit bureau to have them corrected.

In conclusion, there are several ways to boost your approval odds for a credit card application. By checking your credit report, choosing the right card, and applying at the right time, you can increase your chances of getting approved. Providing accurate information, adding a co-signer, and improving your debt-to-income ratio can also help. By staying current on your bills, keeping your credit utilization low, and monitoring your credit score and report, you can maintain a healthy credit profile and improve your chances of getting approved for credit in the future.

Frequently Asked Questions

What are the top ways to boost your approval odds for a credit card application?

When applying for a credit card, there are several steps you can take to improve your approval odds. The first step is to check your credit score and credit report to ensure they are accurate and up-to-date. You can then apply for a card that matches your credit profile, as applying for a card that is out of your league will only lead to rejection.

Another way to improve your chances of approval is to reduce your existing debt and improve your credit utilization ratio. Additionally, you can consider applying for a secured credit card or becoming an authorized user on someone else’s account to build credit history.

Why is my credit score important in the credit card application process?

Your credit score is one of the most important factors that lenders consider when reviewing credit card applications. A higher credit score indicates that you are a low-risk borrower who is more likely to make payments on time and pay off your balance in full. A lower credit score, on the other hand, indicates that you may be a higher risk borrower who is more likely to default on payments or carry a balance.

Therefore, it’s important to check your credit score and credit report before applying for a credit card to ensure that your score is accurate and you are applying for a card that matches your credit profile.

What should I look for in a credit card to maximize my approval odds?

When looking for a credit card to maximize your approval odds, it’s important to consider your credit profile and financial situation. If you have a lower credit score or limited credit history, you may want to consider a secured credit card or a card that is designed for people with no credit or bad credit.

Additionally, you should look for a card with a lower credit limit, as this will reduce the risk for lenders and improve your chances of approval. You may also want to consider a card with a lower interest rate or no annual fee, as these factors can make the card more attractive to lenders.

How can I improve my credit utilization ratio to boost my approval odds?

Your credit utilization ratio is the amount of credit you are using compared to the amount of credit you have available. This ratio is an important factor that lenders consider when reviewing credit card applications, as it indicates your ability to manage credit responsibly.

To improve your credit utilization ratio, you can pay down existing debt and avoid using your credit card for unnecessary purchases. Additionally, you can request a credit limit increase on your existing cards, which will increase the amount of credit you have available and lower your utilization ratio.

What should I do if my credit card application is rejected?

If your credit card application is rejected, don’t panic. There are several steps you can take to improve your chances of approval in the future. First, you should review your credit report and credit score to ensure that there are no errors or inaccuracies that could be affecting your creditworthiness.

Additionally, you can consider applying for a secured credit card or becoming an authorized user on someone else’s account to build credit history. You can also work on reducing your existing debt and improving your credit utilization ratio. Finally, you can wait a few months before applying for another credit card, as this will give you time to improve your credit profile and increase your chances of approval.

How to Get APPROVED For ANY Credit Card (3 Steps)

In conclusion, boosting your approval odds for a credit card application can be achieved through several simple steps. Firstly, ensure that you have a good credit score by paying your bills on time and keeping your credit utilization low. Secondly, research and compare different credit cards to find the best one that suits your financial needs. Lastly, avoid applying for multiple credit cards simultaneously and provide accurate and complete information on your application. By following these tips, you can increase your chances of getting approved for a credit card and enjoy its benefits. Remember to use credit responsibly and always pay your bills on time to maintain a good credit score.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)