Insuring Your Money: How To Get FDIC Coverage When Banking Over $250K

Introduction:

When it comes to banking, protecting your money is a top priority. But what happens if you have more than $250,000 in one bank account? That’s where FDIC coverage comes into play. The Federal Deposit Insurance Corporation (FDIC) provides insurance for deposits up to $250,000, but what about amounts exceeding that limit? In this article, we’ll explore how to get FDIC coverage when banking over $250K and ensure your money is always protected.

Paragraph 1:

You may think that having more than $250,000 in one bank account is uncommon, but it’s more common than you might think. This can happen if you’ve sold a house, received an inheritance, or simply accumulated savings over time. It’s important to make sure that all of your hard-earned money is fully insured and protected, and that’s where the FDIC comes in.

Paragraph 2:

The FDIC has been around since 1933 and provides deposit insurance to protect depositors in case their bank fails. The standard insurance amount is $250,000 per depositor, per insured bank, but there are ways to increase that coverage if you have more than $250K. In this article, we’ll discuss the various ways you can get FDIC coverage when banking over $250K, so you can rest easy knowing your money is always protected.

Insuring Your Money: How to Get FDIC Coverage When Banking Over $250K

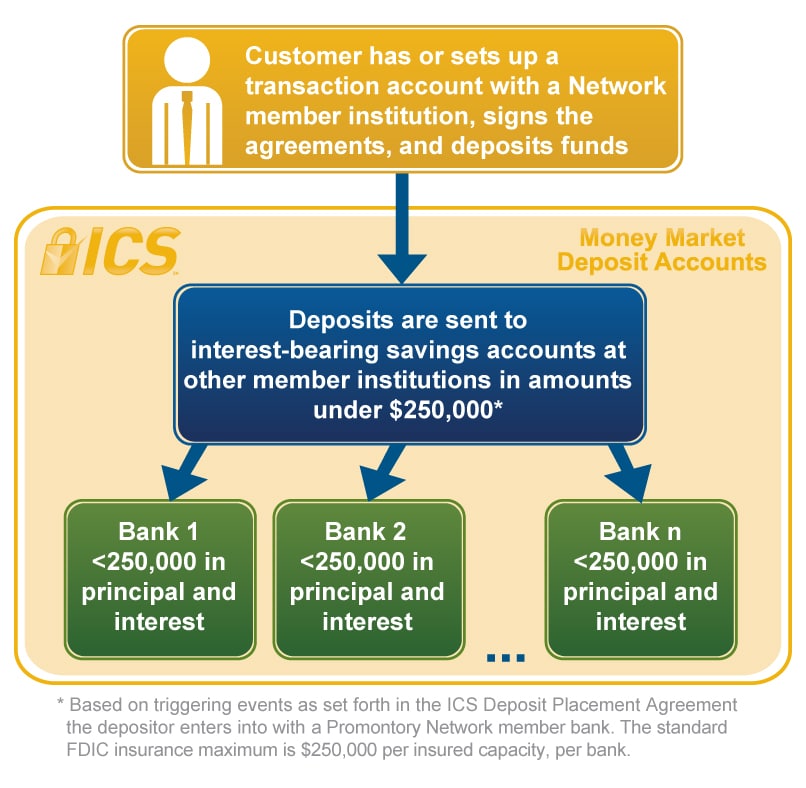

If you want to ensure that your money is protected in case of a bank failure, it’s important to understand how FDIC insurance works. The Federal Deposit Insurance Corporation (FDIC) provides coverage up to $250,000 per depositor, per FDIC-insured bank. If you have more than $250,000 to deposit, you can spread your money across multiple FDIC-insured banks or open different types of accounts, such as joint accounts, to increase your coverage. It’s important to note that not all bank products are FDIC-insured, so be sure to check with your bank before opening an account.

Insuring Your Money: How to Get FDIC Coverage When Banking Over $250K

When it comes to banking, you want to make sure your money is safe and secure. One way to do that is to ensure that your deposits are covered by the Federal Deposit Insurance Corporation (FDIC). But what happens when you have more than $250,000 in deposits? In this article, we’ll explore how you can get FDIC coverage for deposits over $250,000.

Understanding FDIC Coverage

The FDIC is an independent agency of the federal government that provides insurance for deposits at participating banks and savings associations. The insurance coverage is up to $250,000 per depositor, per account type, per institution. This means that if you have more than $250,000 in deposits at one institution, your deposits may not be fully insured.

To determine if your deposits are fully insured, you need to understand how the FDIC calculates coverage. The FDIC looks at the account ownership category, not the account balance, to determine coverage. There are several ownership categories, including single accounts, joint accounts, revocable trust accounts, and more. Each category has its own insurance limit.

Single Accounts

A single account is an account that is owned by one person. The insurance limit for single accounts is $250,000 per depositor, per institution. If you have more than $250,000 in a single account at one institution, the excess amount may not be insured.

Joint Accounts

A joint account is an account that is owned by two or more people. Each person’s share of the account is insured up to $250,000. For example, if you and your spouse have a joint account with $500,000 in deposits, each of you is insured up to $250,000. If the account is owned by more than two people, each person’s share is insured up to $250,000.

Overcoming the $250,000 Limit

If you have more than $250,000 in deposits at one institution, you may be able to get additional FDIC coverage by using different ownership categories. For example, if you have $500,000 in deposits in a single account, you could open a joint account with someone else for $250,000. This would give you a total of $500,000 in FDIC coverage.

Another option is to use different types of accounts, such as checking, savings, and CDs. Each account type has its own insurance limit, so you can have multiple accounts with the same institution and still be fully insured. For example, if you have $500,000 in deposits, you could have $250,000 in a checking account, $250,000 in a savings account, and $250,000 in a CD. This would give you a total of $750,000 in FDIC coverage.

Benefits of FDIC Coverage

FDIC insurance provides peace of mind for depositors. If your bank fails, the FDIC will step in and pay you back, up to the insurance limit. This means that you won’t lose your deposits if your bank fails.

FDIC Coverage vs. Private Insurance

Some banks offer private deposit insurance, which may provide coverage above the FDIC limit. However, private insurance is not backed by the federal government and may not be as secure as FDIC insurance. It’s important to carefully evaluate any private insurance options before choosing them over FDIC insurance.

Conclusion

FDIC insurance is an important tool for protecting your deposits. If you have more than $250,000 in deposits at one institution, it’s important to understand how FDIC coverage works and how you can get additional coverage. By using different ownership categories and account types, you can ensure that your deposits are fully insured and protected.

Frequently Asked Questions

Here are some common questions and answers about getting FDIC coverage when banking over $250K.

What is FDIC coverage?

FDIC stands for Federal Deposit Insurance Corporation. It is an independent agency of the U.S. government that provides insurance to protect depositors in case a bank fails. FDIC coverage means that if your bank fails, you will be reimbursed for up to $250,000 per account. This means that if you have more than $250,000 in a single account, you will need to take additional steps to ensure that all of your money is insured.

If you have multiple accounts at the same bank, such as a checking account and a savings account, each account is insured separately up to $250,000. Joint accounts are also insured separately, with each account holder receiving up to $250,000 in coverage.

What are my options for insuring more than $250,000?

If you have more than $250,000 in a single account, one option is to open additional accounts at the same bank. Each account will be insured up to $250,000, so you can spread your money across multiple accounts to ensure that it is all insured. Another option is to open accounts at different banks. Each bank is insured separately, so you can spread your money across different banks to ensure that it is all insured.

You can also consider opening accounts in different ownership categories. For example, you can have individual accounts, joint accounts, and accounts for different types of trusts. Each ownership category is insured separately, so you can spread your money across different categories to ensure that it is all insured.

How do I know if my bank is FDIC insured?

All FDIC-insured banks are required to display the FDIC logo prominently in their branches and on their websites. You can also use the FDIC’s BankFind tool to search for FDIC-insured banks by name, location, or other criteria. If you are unsure whether your bank is FDIC insured, you can ask a bank representative or contact the FDIC directly.

If your bank is not FDIC insured, your deposits may not be protected in case the bank fails. It is important to make sure that any bank you do business with is FDIC insured.

What types of accounts are covered by FDIC insurance?

FDIC insurance covers a wide range of deposit accounts, including checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). It also covers certain retirement accounts, such as individual retirement accounts (IRAs). However, not all types of financial products are covered by FDIC insurance. For example, stocks, bonds, and mutual funds are not insured by the FDIC.

It is important to understand which types of accounts are covered by FDIC insurance and which are not. If you have questions about whether a particular account is insured, you can contact the FDIC or speak to a bank representative.

Is FDIC insurance the same as SIPC insurance?

No, FDIC insurance is not the same as SIPC (Securities Investor Protection Corporation) insurance. FDIC insurance protects depositors in case a bank fails, while SIPC insurance protects investors in case a brokerage firm fails. SIPC insurance covers up to $500,000 in securities and cash, with a limit of $250,000 in cash. If you have both cash and securities with a brokerage firm, you could be insured for up to $500,000 in total.

It is important to understand the differences between FDIC and SIPC insurance, especially if you have both bank accounts and brokerage accounts. Make sure that you understand how your money is insured and what protections are in place in case of a bank or brokerage failure.

How much money is insured by deposit insurance in a bank?

In conclusion, insuring your money is a crucial step when banking over $250K. The Federal Deposit Insurance Corporation (FDIC) is an independent US government agency that provides insurance coverage for bank deposits. It is important to note that the FDIC only insures deposits that are made in FDIC-insured banks.

To get FDIC coverage, you must ensure that your bank is FDIC-insured, and your deposits do not exceed the FDIC insurance limit of $250K. If your deposits exceed this limit, you can split them between different FDIC-insured banks to ensure that all your funds are covered.

By taking the necessary steps to obtain FDIC coverage, you can have peace of mind knowing that your hard-earned money is protected in case of a bank failure. Remember, being financially responsible includes taking steps to protect your money, and FDIC insurance is an important tool to help you achieve this.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)