CD Investments: How Much You Can Earn And What You Need To Know

Are you looking for a way to make your money work for you? CD investments may be just what you need. With their guaranteed returns and low risk, CDs are a popular choice for many investors. But how much can you really earn with a CD, and what do you need to know before investing? In this article, we’ll explore the ins and outs of CD investments, so you can make an informed decision about whether they’re right for you.

Investing in a CD can be a great way to earn a guaranteed return on your money. The amount you can earn depends on the length of the CD and the interest rate. Generally, the longer the CD term, the higher the interest rate. CDs are FDIC-insured and have low-risk, making them a safe investment option. However, it’s important to note that CDs have early withdrawal penalties and may not offer the highest returns compared to other investment options.

CD Investments: How Much You Can Earn and What You Need to Know

CD (Certificate of Deposit) investments can be a great way to earn a higher interest rate than a traditional savings account. They are also considered a low-risk investment, making them a popular choice for those who want to earn more without taking on too much risk. In this article, we will explore how much you can earn from CD investments and what you need to know before investing.

1. What is a CD investment?

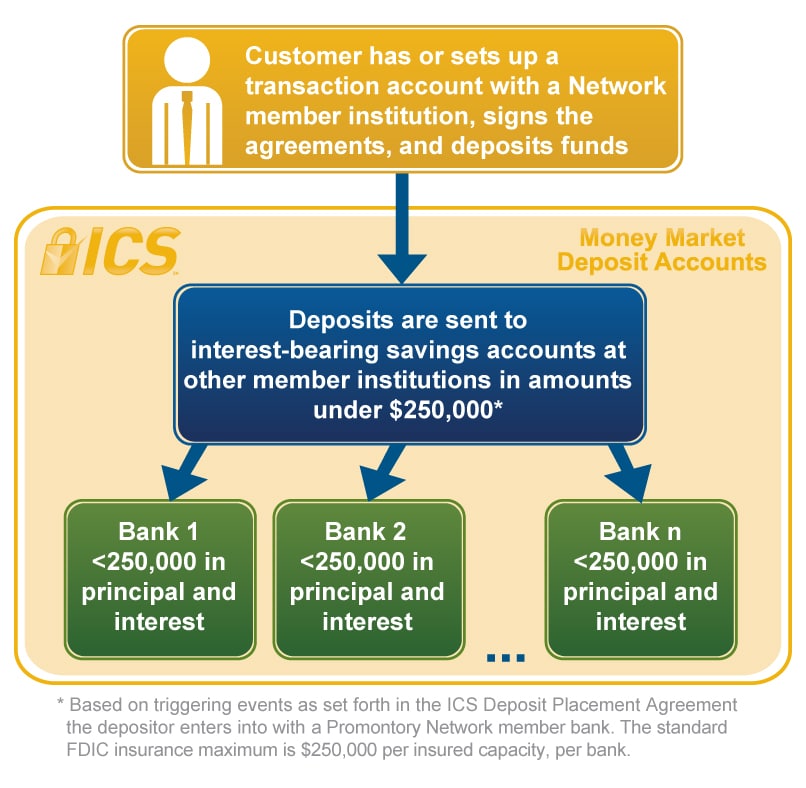

A CD investment is a type of savings account that has a fixed term and a fixed interest rate. Unlike a traditional savings account, you cannot withdraw money from a CD investment until the term is up without incurring a penalty. CD investments are offered by banks and credit unions and are insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000.

2. How much can you earn from a CD investment?

The interest rate on a CD investment varies depending on the term length and the bank or credit union offering the CD. Generally, the longer the term of the CD, the higher the interest rate. As of September 2021, the national average interest rate for a 1-year CD is 0.14%, while the average interest rate for a 5-year CD is 0.36%. However, some banks and credit unions offer higher interest rates than the national average.

For example, Ally Bank offers a 1-year CD with an interest rate of 0.55% and a 5-year CD with an interest rate of 0.85%. Discover Bank offers a 1-year CD with an interest rate of 0.50% and a 5-year CD with an interest rate of 0.75%. It’s important to shop around and compare rates before choosing a CD investment.

3. What are the benefits of CD investments?

CD investments offer several benefits, including a fixed interest rate, low risk, and FDIC insurance. The fixed interest rate means that you know exactly how much you will earn from the investment, unlike a traditional savings account where the interest rate can fluctuate. The low risk of CD investments makes them a popular choice for those who want to earn more than a traditional savings account without taking on too much risk. Finally, FDIC insurance ensures that your investment is protected up to $250,000.

4. What are the disadvantages of CD investments?

CD investments also have some disadvantages to consider. The main disadvantage is that you cannot withdraw money from a CD investment until the term is up without incurring a penalty. This makes CD investments less flexible than a traditional savings account. Additionally, the interest rates on CD investments can be lower than other types of investments, such as stocks or mutual funds. Finally, if you need the money before the CD term is up, you may have to sell the CD on the secondary market, which can result in a loss of principal.

5. What are the different types of CD investments?

There are several different types of CD investments to choose from, including:

– Traditional CDs: These are the most common type of CD investment, with a fixed term and a fixed interest rate.

– Jumbo CDs: These are CDs with a higher minimum deposit requirement than traditional CDs, typically $100,000 or more.

– Callable CDs: These CDs can be called back by the bank before the term is up, which can be both an advantage and a disadvantage.

– Add-on CDs: These CDs allow you to add money to the CD investment during the term.

– IRA CDs: These are CD investments held within an IRA (Individual Retirement Account), offering tax advantages and retirement savings.

6. How do you choose a CD investment?

When choosing a CD investment, there are several factors to consider, including the interest rate, the term length, the minimum deposit requirement, and the penalties for early withdrawal. It’s also important to consider the reputation of the bank or credit union offering the CD and to compare rates from multiple institutions. Finally, consider your own financial goals and needs when choosing a CD investment.

7. CD investments vs. other types of investments

CD investments are a low-risk investment option, making them a good choice for those who want to earn more than a traditional savings account without taking on too much risk. However, CD investments typically offer lower returns than other types of investments, such as stocks or mutual funds. It’s important to consider your own risk tolerance and financial goals when deciding between CD investments and other types of investments.

8. Tips for investing in CD investments

Here are a few tips to keep in mind when investing in CD investments:

– Shop around and compare rates from multiple institutions before choosing a CD investment.

– Consider the term length and the penalties for early withdrawal before investing.

– Consider the reputation of the bank or credit union offering the CD.

– Consider your own financial goals and needs when choosing a CD investment.

– Consider using a ladder strategy, where you invest in CDs with different term lengths to balance risk and return.

9. Risks to consider when investing in CD investments

While CD investments are considered a low-risk investment, there are still some risks to consider, including:

– Inflation risk: CD investments may not keep up with inflation, meaning that the purchasing power of your investment may decrease over time.

– Interest rate risk: If interest rates rise, the interest rate on your CD investment may become less competitive.

– Early withdrawal risk: If you need to withdraw money from your CD investment before the term is up, you may incur a penalty or lose principal if you have to sell the CD on the secondary market.

10. Conclusion

CD investments can be a great way to earn a higher interest rate than a traditional savings account while minimizing risk. However, it’s important to consider the interest rate, term length, minimum deposit requirement, penalties for early withdrawal, and reputation of the bank or credit union offering the CD. By shopping around and considering your own financial goals and needs, you can choose a CD investment that meets your needs and helps you reach your financial goals.

Frequently Asked Questions

CD investments are a popular way to earn interest on your savings while keeping your money safe. Here are some common questions and answers to help you understand how much you can earn and what you need to know.

What is a CD investment?

A CD investment is a type of savings account where you agree to keep your money in the account for a set period of time, ranging from a few months to several years. In exchange for keeping your money in the account, you earn a fixed interest rate that is typically higher than the interest rate on a traditional savings account. CDs are considered to be low-risk investments because your principal is insured by the FDIC up to $250,000 per account.

CDs are offered by banks, credit unions, and other financial institutions. They are a good option for people who want to earn a guaranteed return on their savings without taking on the risk of investing in the stock market.

How much can you earn with a CD investment?

The amount you can earn with a CD investment depends on the interest rate and the length of the term. Generally, the longer the term, the higher the interest rate. For example, a 5-year CD may have an interest rate of 2.5%, while a 1-year CD may have an interest rate of 1%. The interest you earn is typically compounded daily, which means you earn interest on your interest.

Some banks and credit unions offer special CD rates for larger deposits, so it’s worth shopping around to find the best rate for your needs. Keep in mind that CDs typically have early withdrawal penalties if you need to access your money before the term is up.

What are the risks of CD investments?

CDs are considered to be low-risk investments because your principal is insured by the FDIC. However, there are some risks to be aware of. One risk is inflation risk, which is the risk that the interest rate you earn on your CD will not keep up with inflation. This means that your money may not be worth as much in the future as it is today.

Another risk is interest rate risk, which is the risk that interest rates will rise after you invest in a CD. If interest rates rise, you may miss out on the opportunity to earn a higher rate of return on your savings. To minimize these risks, it’s important to choose a CD with a competitive interest rate and to consider investing in a ladder of CDs with different maturity dates.

What is a CD ladder?

A CD ladder is a strategy where you invest in multiple CDs with different maturity dates. For example, you might invest in a 1-year CD, a 2-year CD, a 3-year CD, and a 5-year CD. When the 1-year CD matures, you reinvest the money in a new 5-year CD. When the 2-year CD matures, you reinvest the money in a new 5-year CD, and so on.

A CD ladder can help you earn a higher overall rate of return on your savings while still maintaining access to some of your money on a regular basis. It can also help you minimize interest rate risk by spreading your investments over different maturity dates.

How do you invest in a CD?

To invest in a CD, you typically need to open an account with a bank or credit union that offers CDs. You will need to provide personal information such as your name, address, and social security number, as well as information about the amount of money you want to invest and the term length you are interested in.

Once you open the account, you will typically receive a certificate of deposit that confirms your investment and the interest rate you will earn. Make sure to read the terms and conditions carefully, including any early withdrawal penalties, before investing in a CD.

:max_bytes(150000):strip_icc()/Certificate-of-deposit-2301f2164ceb4e91b100cb92aa6f868a.jpg)

In conclusion, CD investments can be a great way to earn a steady return on your money without having to take on too much risk. By doing your research and finding the right CD for your needs, you can earn a competitive interest rate and potentially grow your savings over time.

However, it’s important to keep in mind that CDs aren’t the only investment option out there. Depending on your goals and risk tolerance, you may want to explore other types of investments as well.

Ultimately, the key to successful investing is to stay informed and make educated decisions that align with your personal financial goals. With the right approach, you can build a solid financial foundation and set yourself up for long-term success.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)