Top 9 Best Homeowners Insurance Companies For Property Coverage

Homeownership comes with a great responsibility of ensuring that your property remains safe and protected against unforeseen damage. This is where homeowners insurance plays a crucial role in safeguarding your property. It can also protect you from stress and other cash management headaches. However, with so many insurance companies out there, finding the right one can be a daunting task. That’s why we have compiled a list of the top 9 best homeowners insurance companies for property coverage to help you make an informed decision and secure your home. Read on to find out which insurance companies made our list and why they stand out from the rest.

- State Farm – Offers comprehensive coverage and discounts for home security features.

- Allstate – Offers customizable coverage options and a range of discounts.

- Amica – Known for excellent customer service and personalized coverage options.

- Liberty Mutual – Offers a variety of coverage options and discounts for bundling policies.

- Nationwide – Provides excellent coverage for high-value homes and offers a range of discounts.

- USAA – Offers affordable coverage options and discounts for military members and their families.

- Erie Insurance – Offers competitive rates and customizable coverage options.

- Travelers – Known for excellent customer service and a range of coverage options.

- Chubb – Offers comprehensive coverage and a range of high-end services for luxury homes.

1. Allstate

Why We Like It: Allstate is a well-known company that offers a variety of coverage options and discounts to help you save money. Their policies are customizable, so you can choose the coverage that best fits your needs.

Who Should Get It: Homeowners who value flexibility and want to customize their policy to fit their needs. Allstate is a great option for those who want to save money with discounts and bundling options.

Pros:

- Customizable policies

- Discounts available

- 24/7 customer service

Cons:

- Higher than average premiums

- Some negative customer reviews

- Limited coverage options in some areas

2. State Farm

Why We Like It: State Farm is a well-established company with a strong financial rating. They offer a variety of coverage options and discounts, including a discount for new homeowners.

Who Should Get It: Homeowners who want a financially stable company with a variety of coverage options and discounts. State Farm is a great option for new homeowners who want to save money with discounts.

Pros:

- Discounts available

- Strong financial rating

- Customizable policies

Cons:

- Higher than average premiums

- Some negative customer reviews

- May not offer coverage in all areas

3. Farmers

Why We Like It: Farmers offers a variety of coverage options, including unique options like eco-rebuild and identity shield. They also offer discounts for bundling policies and for having a home security system.

Who Should Get It: Homeowners who want unique coverage options and discounts. Farmers is a great option for those who want to save money with discounts and bundle their policies.

Pros:

- Unique coverage options

- Discounts for bundling policies

- Discounts for home security systems

- 24/7 customer service

Cons:

- Higher than average premiums

- Some negative customer reviews

- May not offer coverage in all areas

4. Nationwide

Why We Like It: Nationwide offers a variety of coverage options, including a unique option for earthquake coverage. They also offer discounts for bundling policies and for having a home security system.

Who Should Get It: Homeowners who want unique coverage options and discounts. Nationwide is a great option for those who want to save money with discounts and bundle their policies.

Pros:

- Unique coverage options

- Discounts for bundling policies

- Discounts for home security systems

- 24/7 customer service

Cons:

- Higher than average premiums

- Some negative customer reviews

- May not offer coverage in all areas

5. USAA

Why We Like It: USAA offers a variety of coverage options and discounts for military members and their families. They also have a strong financial rating and excellent customer service.

Who Should Get It: Military members and their families who want a financially stable company with a variety of coverage options and discounts. USAA is a great option for those who want to save money with military discounts.

Pros:

- Discounts for military members and their families

- Strong financial rating

- Customizable policies

- Excellent customer service

Cons:

- Only available to military members and their families

- May not offer coverage in all areas

- Higher than average premiums in some areas

6. Liberty Mutual

Why We Like It: Liberty Mutual offers a variety of coverage options and discounts, including a discount for new homeowners. They also have a mobile app for easy access to your policy information.

Who Should Get It: Homeowners who want a variety of coverage options and discounts. Liberty Mutual is a great option for new homeowners who want to save money with discounts and have easy access to their policy information.

Pros:

- Discounts for new homeowners

- Mobile app for easy access to policy information

- Customizable policies

- 24/7 customer service

Cons:

- Higher than average premiums

- Some negative customer reviews

- May not offer coverage in all areas

7. Chubb

Why We Like It: Chubb is a high-end insurance company that offers customizable policies with high coverage limits. They also have excellent customer service and a strong financial rating.

Who Should Get It: Homeowners who have expensive homes and want high coverage limits. Chubb is a great option for those who want a premium insurance experience with customizable policies and excellent customer service.

Pros:

- Customizable policies with high coverage limits

- Excellent customer service

- Strong financial rating

- High coverage limits

Cons:

- Higher than average premiums

- May not offer coverage in all areas

- Only available to high-end homes

8. Travelers

Why We Like It: Travelers offers a variety of coverage options and discounts, including a discount for new homeowners. They also have a mobile app for easy access to your policy information.

Who Should Get It: Homeowners who want a variety of coverage options and discounts. Travelers is a great option for new homeowners who want to save money with discounts and have easy access to their policy information.

Pros:

- Discounts for new homeowners

- Mobile app for easy access to policy information

- Customizable policies

- 24/7 customer service

Cons:

- Higher than average premiums

- Some negative customer reviews

- May not offer coverage in all areas

9. Lemonade

Why We Like It: Lemonade is a digital insurance company that offers a simple, easy-to-use platform. They also offer transparent pricing and fast claims processing.

Who Should Get It: Homeowners who want a simple, easy-to-use insurance platform. Lemonade is a great option for those who value transparency and fast claims processing.

Pros:

- Simple, easy-to-use platform

- Transparent pricing

- Fast claims processing

Cons:

- May not offer coverage in all areas

- Limited coverage options

- Not available in all states

Frequently Asked Questions

Here are some common questions about the top 9 best homeowners insurance companies for property coverage:

1. What factors should I consider when choosing a homeowners insurance company?

When choosing a homeowners insurance company, you should consider several factors. First, you should look at the company’s financial strength and stability, as this will ensure that they are able to pay out claims if necessary. You can check a company’s financial rating with a rating agency such as AM Best or Standard & Poor’s.

You should also consider the coverage options and discounts available, as well as the company’s customer service reputation. It’s a good idea to read reviews from current and past customers to get a sense of their experiences with the company.

2. What does homeowners insurance typically cover?

Homeowners insurance typically covers damage to your home and personal property caused by events such as fire, theft, or severe weather. It also provides liability coverage if someone is injured on your property and sues you for damages. Some policies may also include additional coverage for things like water damage or identity theft.

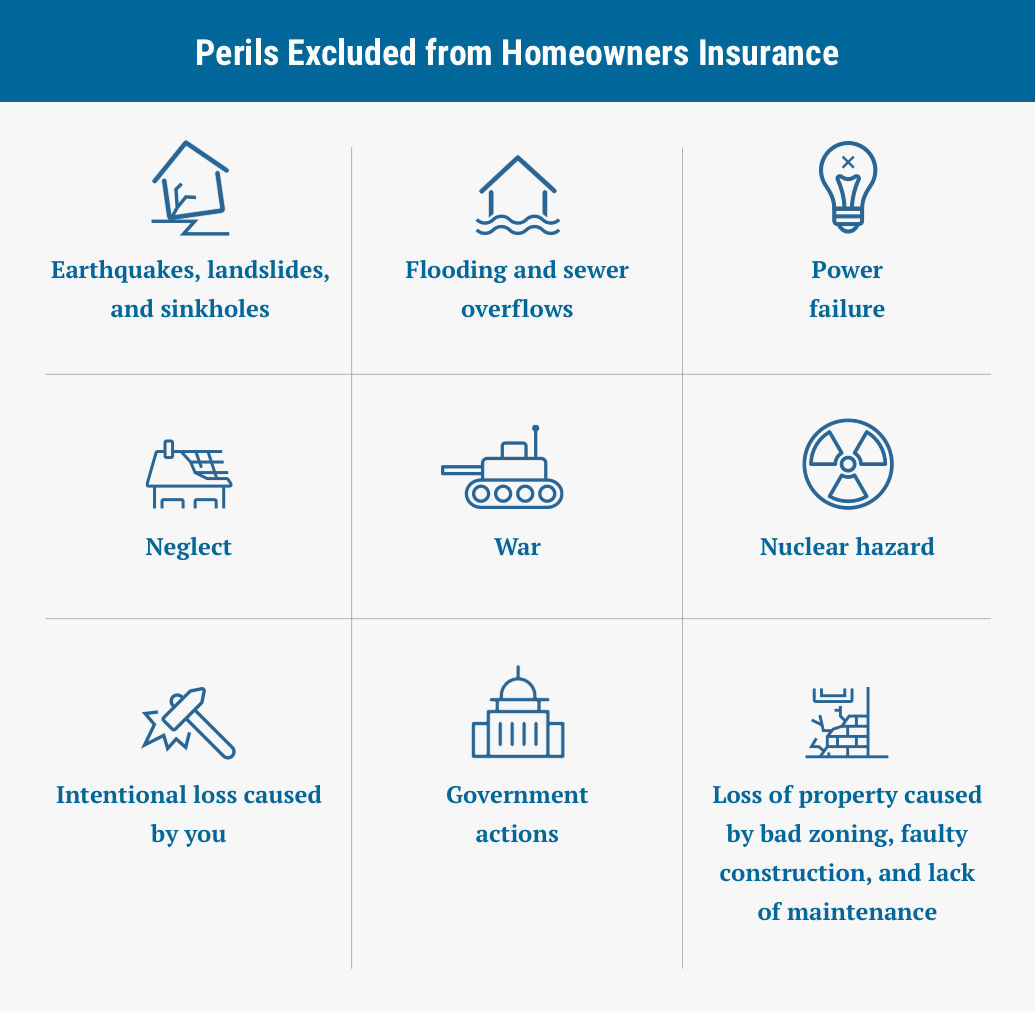

It’s important to read your policy carefully to understand exactly what is covered and what is excluded. You may need to purchase additional coverage for things like flood or earthquake damage.

3. How much Homeowners insurance coverage do I need?

The amount of homeowners insurance coverage you need will depend on several factors, including the value of your home and personal property, as well as your liability risk. You should aim to have enough coverage to fully rebuild your home and replace your personal property if they are destroyed, and to protect your assets in case of a lawsuit.

Your insurance agent can help you determine the appropriate amount of coverage for your needs, but it’s important to regularly review and update your policy to ensure that you are adequately covered.

4. How can I save money on homeowners insurance?

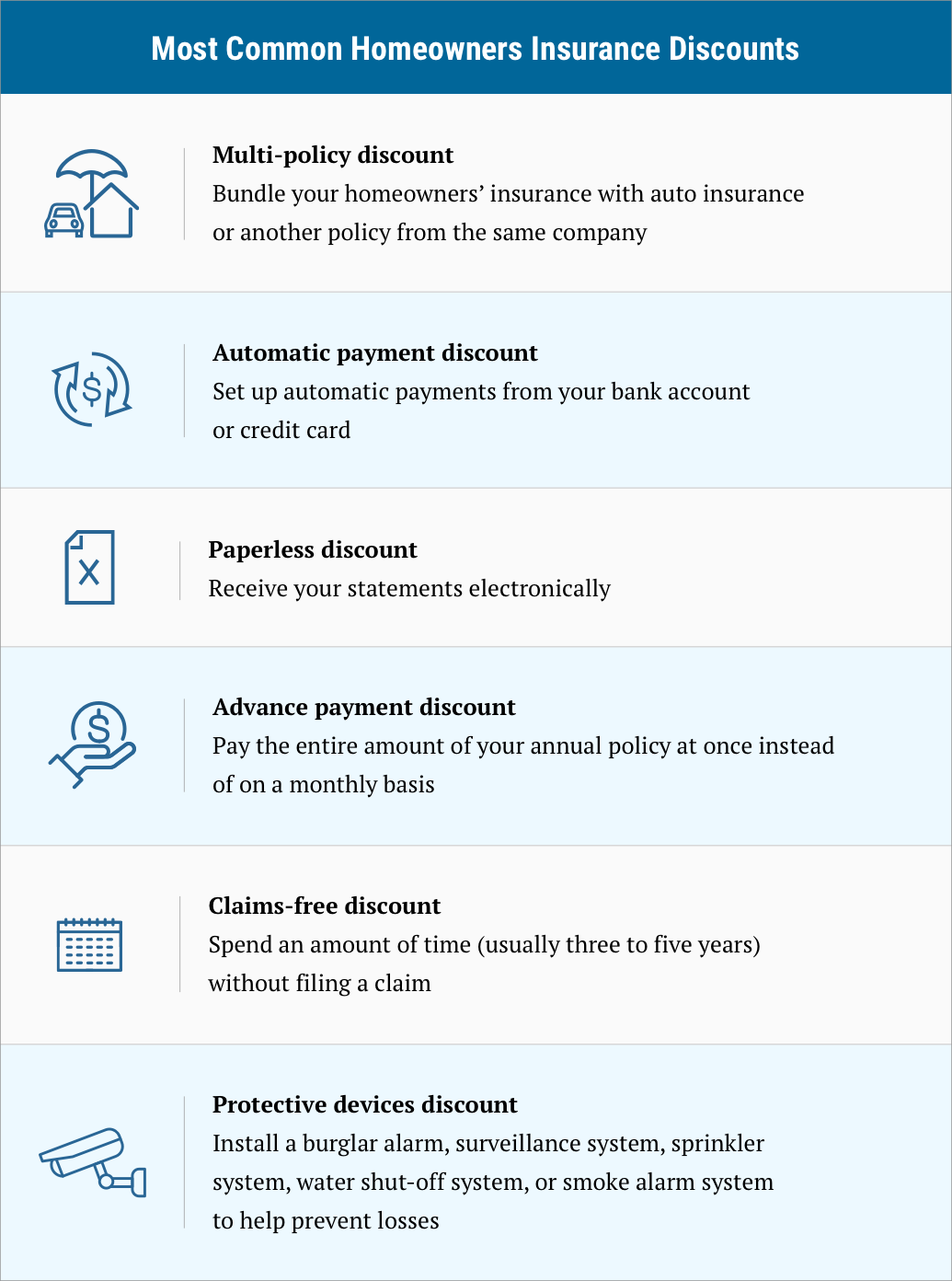

There are several ways to save money on homeowners insurance. One of the most common is to bundle your homeowner’s insurance policy with other policies, such as auto insurance, with the same company. Many companies also offer discounts for installing safety devices in your home, such as smoke detectors or security systems.

You can also save money by increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. However, it’s important to make sure that you can afford to pay the deductible if you need to make a claim.

Just like car insurance, homeowners insurance is important for certain reasons. These top homeowners insurance companies for property coverage offer a wide range of options to fit your specific needs and budget. Whether you are looking for basic coverage or comprehensive protection, there is a policy out there that can provide you with the peace of mind you need to enjoy your home to the fullest. So why wait? Start exploring your options today and protect your home with the best coverage available.