How To Consolidate Debt: Pros, Cons, And Best Practices

If you’re one of the many people struggling with debt, you’re not alone. In fact, according to recent studies, the average American has around $38,000 in personal debt. Consolidating your debt can be a smart move to help you get back on track financially. But before you dive in, it’s important to understand the pros, cons, and best practices for consolidating debt. In this article, we’ll explore everything you need to know to make an informed decision about consolidating your debt.

How to Consolidate Debt: Pros, Cons, and Best Practices

Consolidating debt can be a helpful strategy for those who find themselves struggling with multiple high-interest debts. However, before jumping into consolidating debt, it is important to understand the pros and cons of this approach, as well as the best practices to follow. In this article, we will discuss everything you need to know about debt consolidation.

What is Debt Consolidation?

Debt consolidation is the process of combining multiple debts into one single debt. This can be done through various methods, such as taking out a personal loan, using a balance transfer credit card, or utilizing a debt consolidation program. By consolidating debt, individuals can simplify their monthly payments and potentially lower their interest rates.

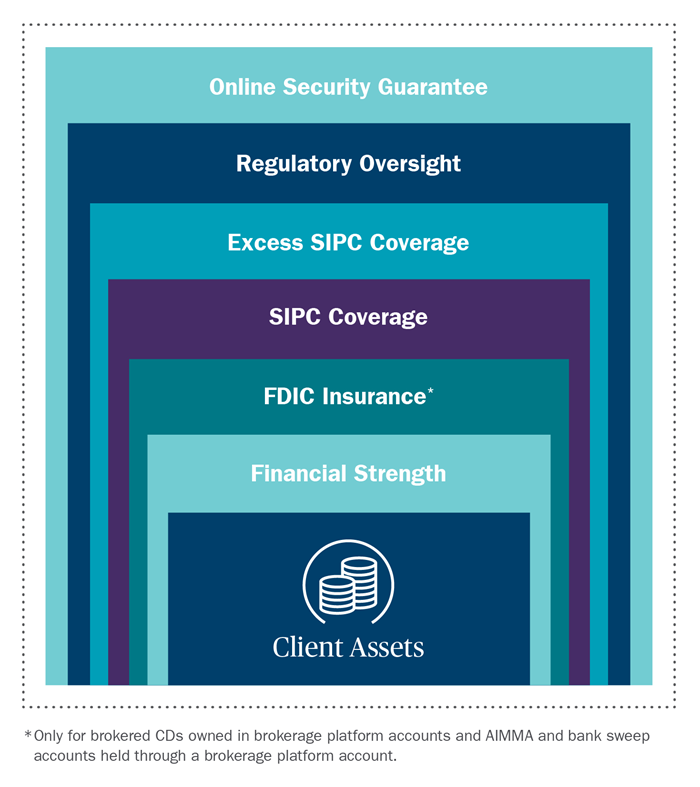

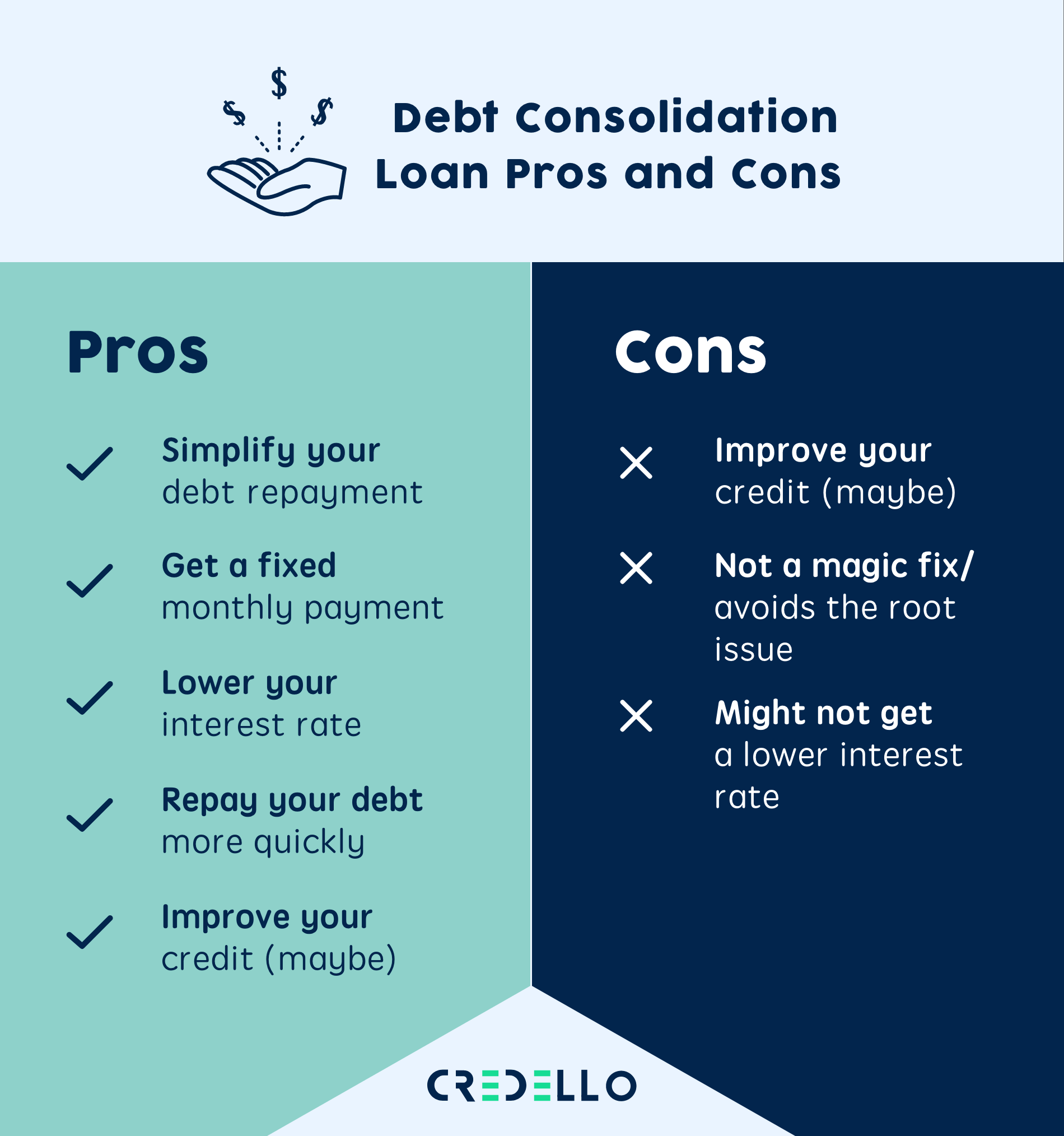

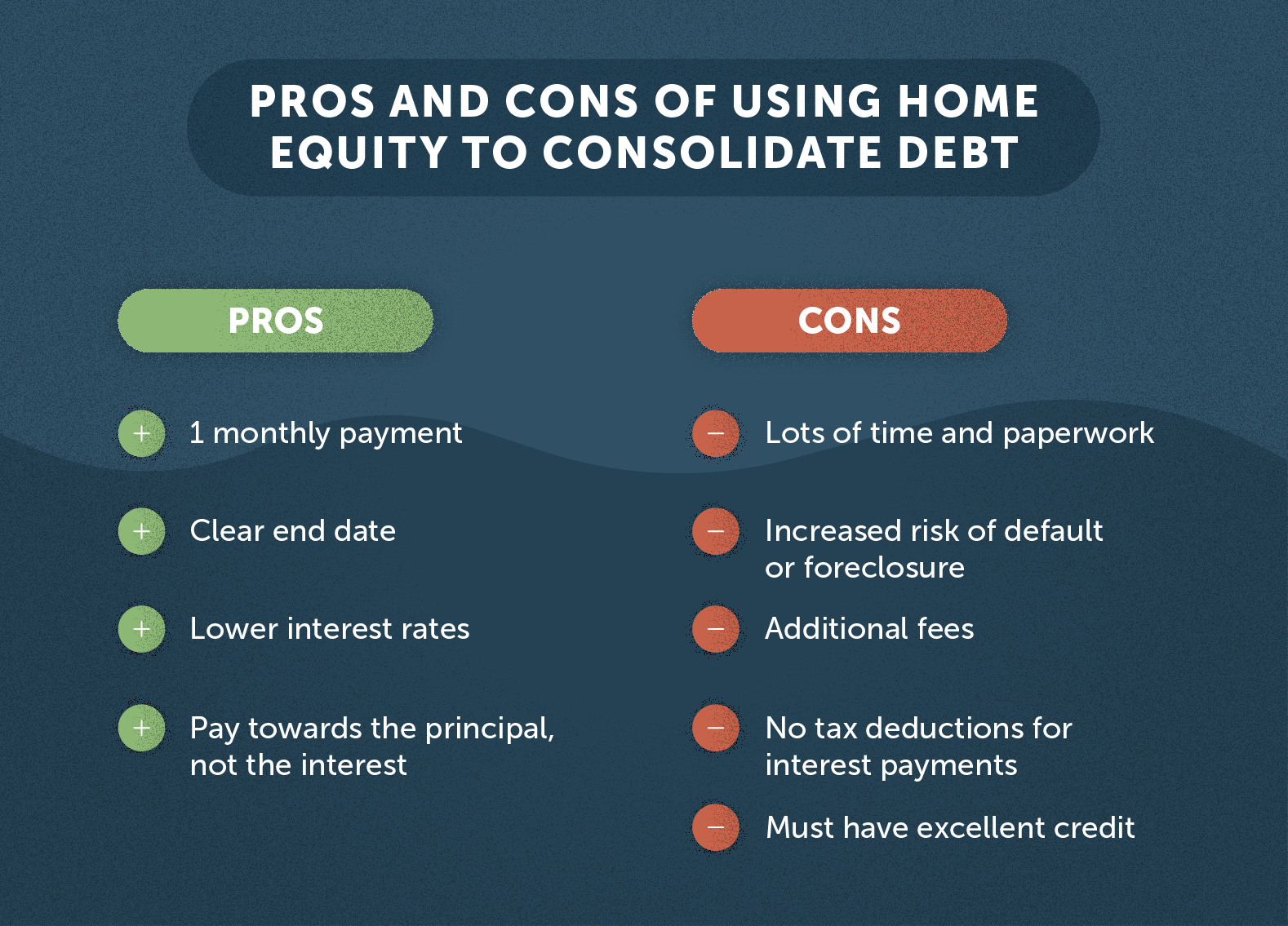

The Pros of Debt Consolidation

There are several advantages to consolidating debt, including:

- Lower Interest Rates: Debt consolidation can potentially lower interest rates, which can save you money in the long run.

- One Payment: Consolidating debt means you only have to make one monthly payment, which can help simplify your finances and budgeting.

- Improved Credit Score: By making consistent payments, you can improve your credit score over time.

The Cons of Debt Consolidation

While there are benefits to debt consolidation, there are also some downsides to consider, such as:

- Extended Repayment: Consolidating debt can extend your repayment period, which can lead to paying more in interest over time.

- Additional Fees: Depending on the method of consolidation, there may be fees associated with the process.

- Temptation to Accumulate More Debt: Consolidating debt can free up credit, which may tempt individuals to accumulate more debt.

The Best Practices for Debt Consolidation

There are several best practices to follow when consolidating debt, including:

1. Evaluate Your Debts

Before consolidating debt, it is important to evaluate all of your debts and determine the total amount owed, interest rates, and monthly payments. This will help you determine if consolidation is the right option for you.

2. Choose the Right Method

There are various methods for consolidating debt, so it is important to choose the one that best fits your financial situation. For example, a personal loan may be a good option if you have good credit and want a fixed interest rate.

3. Create a Repayment Plan

Once you have consolidated your debt, it is important to create a repayment plan and stick to it. This will help you pay off your debt in a timely manner and avoid accumulating more debt.

4. Avoid Accumulating More Debt

Consolidating debt can free up credit, but it is important to avoid accumulating more debt. This can be done by creating a budget, avoiding unnecessary expenses, and using credit responsibly.

5. Seek Professional Help if Needed

If you are struggling with debt, it may be helpful to seek professional help from a credit counseling agency or financial advisor. They can provide guidance and support as you work towards becoming debt-free.

Conclusion

Consolidating debt can be a helpful strategy for simplifying finances and potentially lowering interest rates. However, it is important to weigh the pros and cons and follow best practices to ensure success. By evaluating your debts, choosing the right method, creating a repayment plan, avoiding accumulating more debt, and seeking professional help if needed, you can take control of your finances and become debt-free.

Frequently Asked Questions

Debt consolidation is a popular method for managing debt. However, before deciding to consolidate your debt, it’s important to understand the pros, cons, and best practices. Here are some frequently asked questions and their answers to help you make an informed decision.

What is debt consolidation and how does it work?

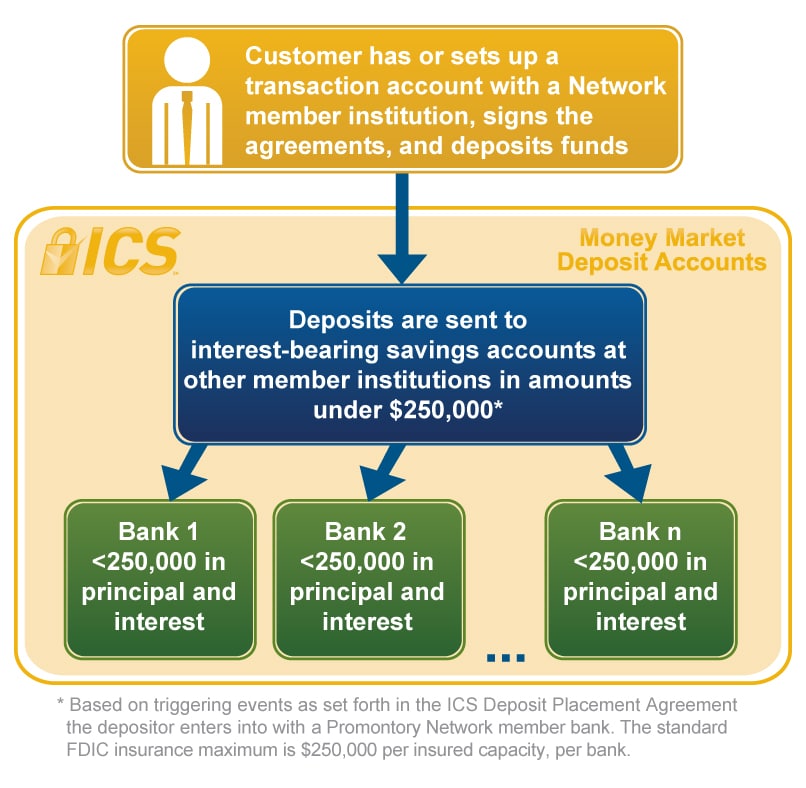

Debt consolidation involves combining multiple debts into one loan or payment plan. This can be done through a balance transfer credit card, a personal loan, or a debt consolidation loan. The goal is to simplify your debt payments and potentially lower your interest rates and monthly payments.

When you consolidate your debt, you take out a new loan to pay off your existing debts. This leaves you with one monthly payment to make, rather than multiple payments to different creditors. The new loan typically has a lower interest rate than your previous debts, which can save you money in the long run.

What are the benefits of debt consolidation?

Debt consolidation can be beneficial in several ways. It can simplify your debt payments by consolidating multiple debts into one payment. It can also potentially lower your interest rates, which can save you money over time. Debt consolidation can also make it easier to manage your finances and stay on top of your payments.

Additionally, consolidating your debt can improve your credit score by reducing your credit utilization ratio. This is the amount of available credit you’re using, and a lower ratio can improve your credit score. Debt consolidation can also help you avoid late payments and defaulting on your debts, which can negatively impact your credit score.

What are the drawbacks of debt consolidation?

While debt consolidation can be beneficial, there are also some drawbacks to consider. Consolidating your debt can extend your repayment timeline, which means you’ll be in debt for a longer period of time. This can also mean paying more in interest over time, even if your interest rate is lower.

Consolidating your debt can also come with fees, such as balance transfer fees or loan origination fees. These fees can add up and increase the cost of your consolidation loan. Additionally, if you’re consolidating credit card debt, it’s important to avoid using your credit cards while you’re paying off your consolidation loan. Otherwise, you could end up with more debt than you started with.

What are some best practices for debt consolidation?

Before consolidating your debt, it’s important to do your research and compare your options. Look for a loan or credit card with a low interest rate and minimal fees. You should also consider your repayment timeline and monthly payment amount to ensure it’s manageable for your budget.

Once you’ve consolidated your debt, it’s important to avoid taking on new debt. This means avoiding using your credit cards for unnecessary purchases and focusing on paying off your consolidation loan or credit card balance. You should also consider creating a budget to help you manage your finances and stay on top of your payments.

Is debt consolidation right for me?

Whether debt consolidation is right for you depends on your individual financial situation. If you have multiple debts with high interest rates and struggle to make your payments each month, debt consolidation may be a good option for you. However, if you have a low amount of debt or can manage your payments with your current repayment plan, debt consolidation may not be necessary.

Before deciding to consolidate your debt, it’s important to consider the pros, cons, and best practices to ensure it’s the right choice for you. You should also speak with a financial advisor or debt counselor to discuss your options and create a plan that works best for your financial goals and needs.

Debt Consolidation: The [CORRECT WAY] To Do It | Debt Consolidation Credit Cards

In conclusion, consolidating your debt can be a great option for those looking to simplify their payments and potentially save money on interest rates. However, it’s important to weigh the pros and cons carefully and explore all of your options before making a decision.

It’s also important to practice good financial habits to prevent getting into debt in the first place. This includes budgeting, saving for emergencies, and avoiding unnecessary expenses.

Overall, consolidating debt can be a valuable tool in achieving financial stability, but it should be approached with caution and an understanding of the potential risks and benefits. With the right mindset and financial strategies, anyone can take control of their debt and achieve their financial goals.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)