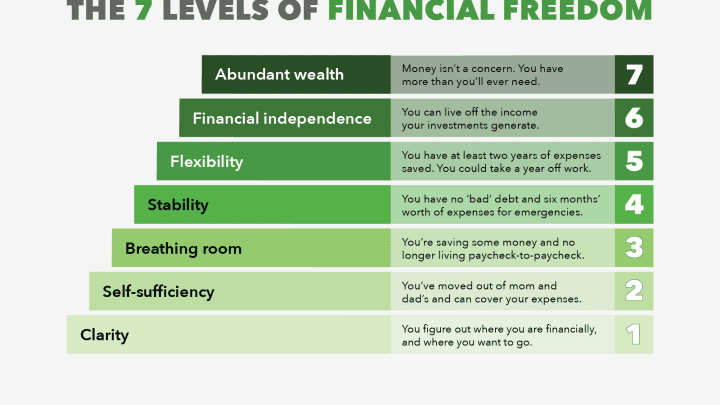

Strategies To Find Debt Relief And Regain Financial Freedom

Debt can be a major source of stress and anxiety, affecting every aspect of your life. Whether you are struggling with credit card debt, student loans, or medical bills, the burden of debt can feel overwhelming. But there is hope. With the right strategies, you can find debt relief and regain financial freedom. In this article, we will explore some effective ways to tackle your debt and take control of your finances.

Strategies to Find Debt Relief and Regain Financial Freedom: If you’re struggling with debt, there are several strategies you can use to find relief and regain control of your finances. One option is to create a budget and stick to it, cutting out unnecessary expenses. Another is to negotiate with creditors or seek the help of a debt consolidation service. You can also consider debt settlement or bankruptcy as a last resort. Whatever strategy you choose, it’s important to take action and address your debt as soon as possible to avoid further financial harm.

Strategies to Find Debt Relief and Regain Financial Freedom

Excessive debt can be a significant burden on one’s finances, leading to stress and anxiety. It can be challenging to find a way out of debt, but with the right strategies, it can be done. Here are ten effective ways to find debt relief and regain financial freedom.

1. Create a Budget

The first step towards finding debt relief is creating a budget. A budget helps you understand your financial situation and determine how much money you can allocate towards debt repayment. Start by listing all your sources of income and expenses, including rent, utilities, food, transportation, and entertainment. Once you have a clear idea of your finances, look for areas where you can cut back and redirect the saved funds towards paying off your debts.

Creating a budget is easy, and there are many online tools available to help you. A budget can help you stay on track, avoid overspending, and keep your finances in check.

2. Prioritize Your Debts

If you have multiple debts, it’s essential to prioritize them based on their interest rates and balances. Start by paying off debts with the highest interest rates, as they can accumulate quickly and add to your financial burden. Once you’ve paid off the high-interest debts, move on to the ones with lower interest rates.

Another strategy is to focus on debts with the smallest balances first. This method is known as the debt snowball method, and it can help you gain momentum and motivation as you see progress in paying off your debts.

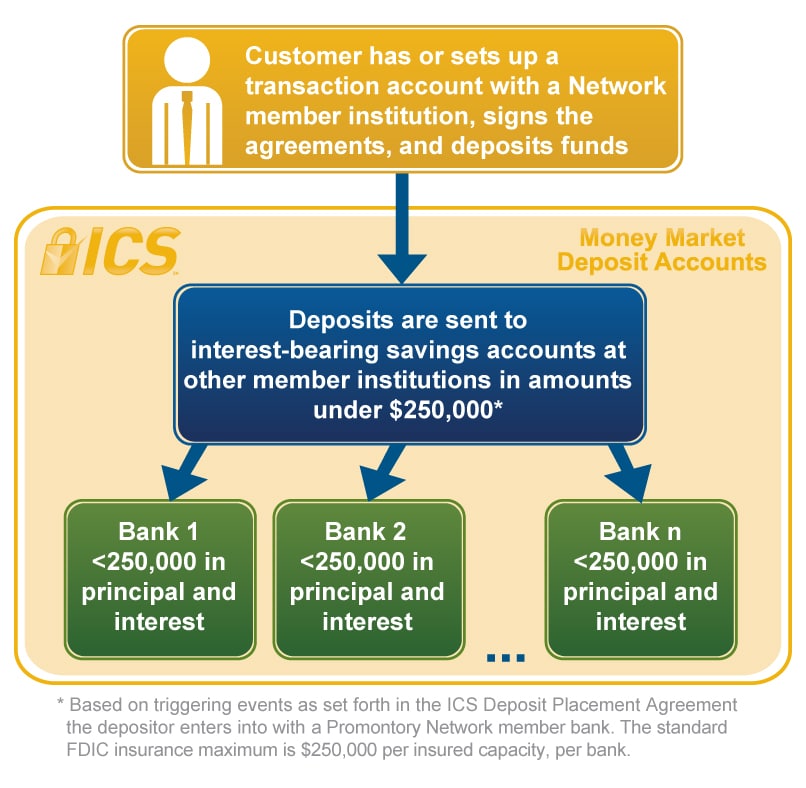

3. Consolidate Your Debts

Debt consolidation is the process of combining multiple debts into one loan with a lower interest rate. Consolidating your debts can make your payments more manageable and save you money on interest charges. There are several options for debt consolidation, including balance transfer credit cards, personal loans, and home equity loans.

Before consolidating your debts, make sure you understand the terms and fees associated with the loan. Also, be aware that consolidating your debts does not eliminate them; it only makes them more manageable.

4. Negotiate with Creditors

If you’re struggling to make your debt payments, consider negotiating with your creditors. Creditors may be willing to work with you to create a payment plan or reduce your interest rates. Be honest and upfront about your financial situation, and provide any documentation that supports your case.

Keep in mind that creditors are not obligated to negotiate with you, but it’s worth a try. A successful negotiation can result in lower monthly payments, reduced interest rates, and waived fees.

5. Seek Professional Help

If you’re overwhelmed with debt and can’t seem to find a way out, consider seeking professional help. Credit counseling agencies can provide guidance and support in managing your debts, creating a budget, and negotiating with creditors.

Debt settlement companies can help you settle your debts for less than what you owe, but be cautious of scams and high fees. Bankruptcy is also an option for those with overwhelming debt, but it should be considered as a last resort.

6. Increase Your Income

Increasing your income is another way to find debt relief. Consider taking on a part-time job or selling unused items to generate extra cash. You can also look for opportunities to earn passive income, such as renting out a spare room or starting a side business.

Increasing your income can help you pay off your debts faster and reduce the amount of interest you pay in the long run.

7. Cut Back Your Expenses

Cutting back your expenses is another way to find debt relief. Look for areas where you can cut back, such as eating out less, cancelling unused subscriptions, or shopping for deals.

Reducing your expenses can free up more money to put towards your debts and help you stay on track with your budget.

8. Use Windfalls Wisely

If you receive a windfall, such as a tax refund or bonus, use it wisely. Consider putting the money towards your debts instead of spending it on unnecessary expenses.

Using windfalls to pay off your debts can help you make significant progress towards becoming debt-free.

9. Stay Motivated

Staying motivated is essential when finding debt relief. Track your progress, celebrate your successes, and stay focused on your goals. Consider joining a support group or finding an accountability partner to help you stay on track.

Remember that becoming debt-free is a journey, and it takes time and effort. Stay motivated and keep pushing forward.

10. Avoid Future Debt

Finally, to maintain your financial freedom, it’s essential to avoid future debt. Create a plan to live within your means, avoid unnecessary expenses, and save for emergencies.

Avoid using credit cards to finance your lifestyle and consider setting up automatic savings to help you reach your financial goals.

Benefits of Finding Debt Relief

- Reduced financial stress and anxiety

- Improved credit score and financial health

- Increased savings and financial security

- Freedom to pursue your goals and dreams

Debt Relief vs. Bankruptcy

Debt relief and bankruptcy are two options for those struggling with debt, but they have different consequences. Debt relief can help you manage your debts and avoid bankruptcy. Bankruptcy, on the other hand, can provide a fresh start but can have long-term effects on your credit score and financial future.

Before considering bankruptcy, explore other debt relief options and seek the advice of a professional.

Conclusion

Finding debt relief and regaining financial freedom is possible with the right strategies and mindset. Create a budget, prioritize your debts, consolidate your debts, negotiate with creditors, seek professional help, increase your income, cut back your expenses, use windfalls wisely, stay motivated, and avoid future debt.

Remember that becoming debt-free is a journey, and it takes time and effort. Stay focused on your goals, and don’t give up. With perseverance and determination, you can achieve financial freedom and live the life you’ve always wanted.

Frequently Asked Questions

What are some strategies to find debt relief?

Debt can be overwhelming, but there are several strategies to help you find relief. One of the most effective is to create a budget and stick to it. This will help you identify areas where you can cut back on spending, freeing up more money to put towards paying off your debt. Another strategy is to negotiate with your creditors for lower interest rates, which can help reduce the amount you owe over time. Debt consolidation is also an option, which involves taking out a new loan to pay off multiple debts, leaving you with just one monthly payment to manage.

It’s important to remember that finding debt relief takes time and effort. You may need to make sacrifices and cut back on spending in order to reach your goals. But with persistence and determination, you can regain control of your finances and achieve financial freedom.

How can I prioritize which debts to pay off first?

When you have multiple debts, it can be difficult to know where to start. One strategy is to focus on paying off debts with the highest interest rates first. These debts are costing you more money in interest charges, so by paying them off first, you can save money in the long run. Another approach is to pay off the smallest debts first, which can give you a sense of accomplishment and motivation to keep going.

Regardless of which strategy you choose, it’s important to make at least the minimum payments on all of your debts to avoid late fees and damage to your credit score. You can also consider consolidating your debts into a single loan to make repayment more manageable.

What are some ways to increase my income to help pay off debt?

Increasing your income is a great way to help pay off debt faster. One option is to look for a higher paying job or take on additional work through a side hustle or freelance gig. You can also consider selling items you no longer need or use, such as clothes, electronics, or furniture, to generate extra cash.

Another strategy is to cut back on expenses, such as eating out or subscription services, and redirect that money towards paying off your debt. By making small changes to your spending habits and finding ways to increase your income, you can make a significant impact on your debt repayment journey.

How can I avoid falling back into debt after becoming debt-free?

After becoming debt-free, it’s important to take steps to ensure you don’t fall back into debt. One strategy is to continue living within your means and sticking to a budget. This will help you avoid overspending and accumulating new debt.

You can also build an emergency fund to cover unexpected expenses, such as car repairs or medical bills, without going into debt. Additionally, it’s important to avoid using credit cards or taking out loans unless absolutely necessary.

Finally, consider seeking the advice of a financial planner or counselor to help you develop a long-term financial plan and stay on track towards achieving your financial goals.

What should I do if I can’t afford to make my debt payments?

If you’re struggling to make your debt payments, it’s important to take action right away. Ignoring the problem will only make it worse. One option is to contact your creditors and explain your situation. They may be willing to work out a payment plan or temporarily lower your interest rates.

You can also consider credit counseling or debt management programs, which can help you develop a plan to pay off your debts and negotiate with your creditors on your behalf. In some cases, bankruptcy may be an option, but it should be a last resort and only considered after exploring all other options.

Remember, there is always a way out of debt, but it takes time, effort, and a willingness to make changes to your financial habits.

Get Rid of Debt Collections and Regain Financial Freedom with These 5 Strategies

In conclusion, finding debt relief and regaining financial freedom requires a combination of strategies and a commitment to implementing them consistently. It may not be easy, but it is achievable. By identifying the root causes of your debt, creating a budget and reducing expenses, negotiating with creditors, and seeking professional assistance if necessary, you can take control of your finances and pave the way to a debt-free future.

Remember, debt is not a life sentence. With the right mindset and actions, you can break free from the cycle of debt and start building financial stability and security. Whether it involves making sacrifices in the short-term or pursuing long-term goals, every step you take towards debt relief is a step in the right direction.

So, take the first step today. Start by assessing your financial situation, identifying your goals, and creating a plan of action. With dedication and perseverance, you can overcome your debt and achieve the financial freedom you deserve.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)