Step-by-Step Guide: How To Freeze Your Credit To Prevent Identity Theft?

Identity theft is a rampant issue that affects millions of people worldwide. It can happen to anyone at any time, and the consequences can be devastating. One way to safeguard your identity is by freezing your credit. In this step-by-step guide, we will show you how to freeze your credit and prevent identity theft.

Freezing your credit is a simple process that can give you peace of mind. It can prevent hackers, scammers, and other cybercriminals from accessing your credit report and using your personal information to commit fraud. In this guide, we will provide you with clear instructions and tips on how to freeze your credit effectively.

- Contact each of the three major credit bureaus: Equifax, Experian, and TransUnion.

- Provide your personal information and request a credit freeze.

- Pay any necessary fees (varies by state).

- Receive a confirmation letter with your unique PIN for future use.

- When you need to temporarily lift the freeze, provide your PIN to the respective bureau.

Step-by-Step Guide: How to Freeze Your Credit to Prevent Identity Theft

What is a Credit Freeze?

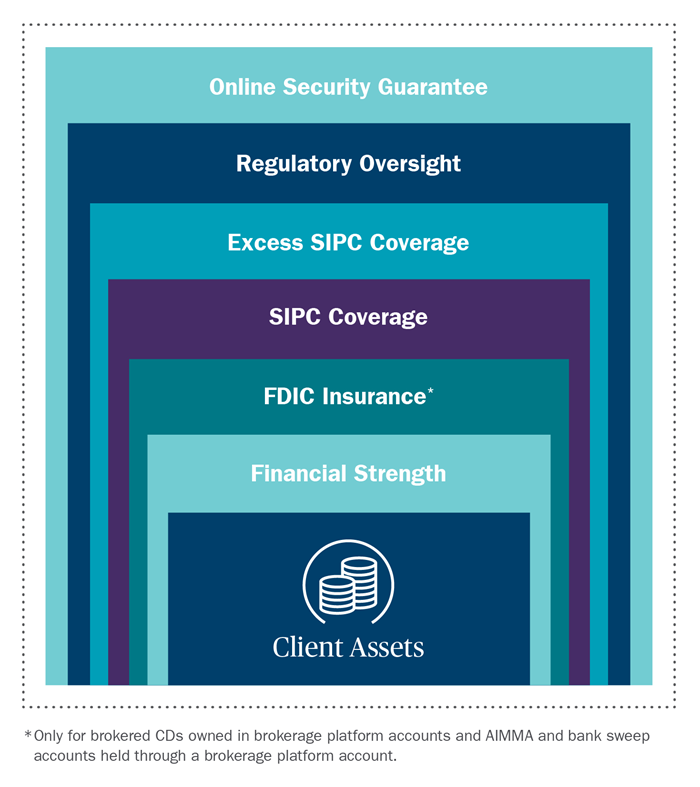

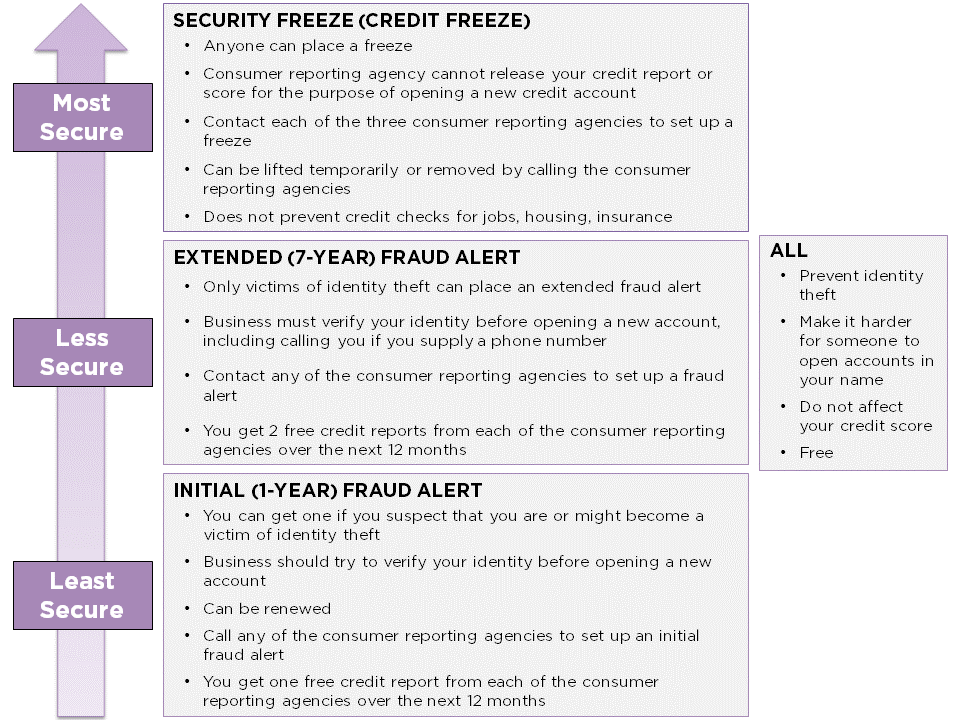

A credit freeze, also known as a security freeze, is a tool used to prevent unauthorized access to your credit report by potential creditors. It is a proactive measure that can help prevent identity theft and fraud. When you freeze your credit, you are essentially locking down your credit report so that no one can access it without your permission. This means that lenders, credit card companies, and other potential creditors will not be able to pull your credit report or open new accounts in your name.

To freeze your credit, you will need to contact each of the three credit bureaus: Equifax, Experian, and TransUnion. You can do this online, by phone, or by mail. When you request a credit freeze, you will need to provide some personal information, such as your name, address, date of birth, and Social Security number. You may also need to provide proof of identification, such as a copy of your driver’s license or passport.

The Benefits of a Credit Freeze

A credit freeze can offer several benefits, including:

– Preventing unauthorized access to your credit report

– Stopping new accounts from being opened in your name

– Protecting your credit score

– Reducing the risk of identity theft and fraud

The Drawbacks of a Credit Freeze

There are also some drawbacks to consider when deciding whether or not to freeze your credit:

– It can be time-consuming and inconvenient to freeze and unfreeze your credit when you want to apply for new credit

– You will need to pay a fee to freeze and unfreeze your credit

– A credit freeze does not protect you from all types of identity theft, such as when someone steals your Social Security number and uses it to file a tax return or apply for government benefits

How to Freeze Your Credit

To freeze your credit, you will need to follow these steps:

1. Contact each of the three credit bureaus: Equifax, Experian, and TransUnion.

2. Provide your personal information, such as your name, address, date of birth, and Social Security number.

3. Provide proof of identification, such as a copy of your driver’s license or passport.

4. Pay the fee to freeze your credit. The fee may vary by state, but it is typically around $10 per credit bureau.

5. Keep a record of your PIN, which you will need to unfreeze your credit in the future.

It is important to note that freezing your credit will not affect your credit score. It also does not prevent you from accessing your own credit report or from using your existing credit accounts.

How to Unfreeze Your Credit

When you want to apply for new credit, you will need to unfreeze your credit. To do this, you will need to follow these steps:

1. Contact each of the three credit bureaus: Equifax, Experian, and TransUnion.

2. Provide your personal information, such as your name, address, date of birth, and Social Security number.

3. Provide your PIN, which you received when you froze your credit.

4. Pay the fee to unfreeze your credit. The fee may vary by state, but it is typically around $10 per credit bureau.

5. Wait for the credit bureau to lift the freeze, which can take up to three business days.

It is important to remember that unfreezing your credit is not an instant process. You will need to plan ahead and give yourself enough time to unfreeze your credit before applying for new credit.

Credit Freeze vs. Fraud Alert

A fraud alert is another tool you can use to protect your credit. Unlike a credit freeze, a fraud alert does not lock down your credit report. Instead, it notifies potential creditors that they should take extra precautions to verify your identity before opening new accounts in your name. A fraud alert is free to place and can be renewed every 90 days.

While a fraud alert can offer some protection, it is not as strong as a credit freeze. A fraud alert does not prevent new accounts from being opened in your name, and it may not stop all types of identity theft.

The Bottom Line

A credit freeze is a powerful tool you can use to protect your credit and prevent identity theft. While it may be inconvenient and come with some drawbacks, the benefits of a credit freeze can far outweigh the costs. If you want to freeze your credit, be sure to follow the steps outlined above and keep track of your PIN so you can unfreeze your credit when you need to.

Frequently Asked Questions

Q: What is credit freeze and how does it prevent identity theft?

A credit freeze is a security measure that restricts access to your credit report. When you freeze your credit, no one can open a new line of credit in your name until you unfreeze it. This means that if a thief tries to use your personal information to open a new account, the lender will be unable to access your credit report and will therefore deny the application. By freezing your credit, you can prevent identity theft from occurring.

However, it is important to note that a credit freeze does not prevent all types of identity theft. It only prevents thieves from opening new credit accounts in your name. If a thief already has access to your existing accounts, they can still use your information to make fraudulent purchases or withdraw money from your accounts.

Q: How do I freeze my credit?

Freezing your credit is a simple process. You can contact each of the three major credit bureaus – Equifax, Experian, and TransUnion – either online or by phone. You will need to provide your personal information and answer some security questions to confirm your identity. Once you have requested a credit freeze, the credit bureau will send you a confirmation letter with instructions on how to unfreeze your credit if necessary.

It is important to note that each credit bureau may have different procedures for freezing your credit. Be sure to follow the instructions provided by each bureau carefully to ensure that your credit is frozen correctly.

Q: How long does a credit freeze last?

A credit freeze will remain in effect until you choose to lift it. In most cases, a credit freeze will remain in place indefinitely until you request to have it removed. However, some states have laws that require credit freezes to be automatically lifted after a certain period of time, such as seven years.

If you need to temporarily unfreeze your credit, such as when applying for a new loan or credit card, you can do so by contacting the credit bureau and providing your PIN or password. Once you have unfrozen your credit, it will remain unfrozen for a specified period of time before automatically freezing again.

Q: Is there a cost to freeze my credit?

In most cases, there is a small fee to freeze your credit. The cost varies by state and by credit bureau, but typically ranges between $5 and $10. Some states may allow certain individuals, such as victims of identity theft, to freeze their credit for free.

It is important to note that unfreezing your credit may also come with a fee. Again, the cost varies by state and by credit bureau, but typically ranges between $5 and $10.

Q: Will a credit freeze affect my credit score?

No, a credit freeze will not affect your credit score. When you freeze your credit, your credit report is still available to you and to certain entities, such as government agencies and existing creditors. However, lenders and other creditors will not be able to access your credit report to open new accounts.

It is important to note that freezing your credit will not improve your credit score either. If you want to improve your credit score, you will need to take other steps, such as paying bills on time, keeping your credit utilization low, and disputing errors on your credit report.

In conclusion, freezing your credit is an effective way to prevent identity theft. By following the step-by-step guide outlined in this article, you can take control of your financial data and safeguard yourself against fraud. Remember, freezing your credit does not have to be a daunting task. With a little bit of research and the right resources, you can easily navigate the process and rest easy knowing that your credit report is secure.

In addition to freezing your credit, it’s also important to monitor your credit report regularly. By staying vigilant and keeping an eye out for any suspicious activity, you can catch potential fraud before it becomes a major problem. And if you do suspect that your identity has been stolen, don’t hesitate to take action. Contact your financial institutions and credit reporting agencies immediately to report any fraudulent activity and start the process of recovering your identity.

Overall, taking steps to protect your credit and personal information is essential in today’s digital age. By taking advantage of the tools available to you, such as credit freezes and credit monitoring services, you can stay one step ahead of identity thieves and keep your financial life secure. So, don’t wait any longer. Take action today and start protecting your credit and your future.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)