How To Get Your Free Credit Score And Report?

Are you curious about your credit score and report but don’t want to pay for it? Worry no more! In this article, we’ll show you how to obtain your credit score and report for free. Knowing your credit history is essential for financial planning, and we want to help you take control of your financial future. So let’s get started!

- Visit AnnualCreditReport.com, the only authorized website for free credit reports.

- Click on “Request your free credit reports.”

- Fill out the required information and select which reports you want to receive.

- Answer the security questions to verify your identity.

- View and download your free credit reports.

How to Get Your Free Credit Score and Report

Are you curious about your credit score and financial history? Do you want to know if you’re a good candidate for a loan or credit card? Luckily, you can easily access your credit score and report for free. In this article, we’ll go over the steps you can take to get your free credit score and report.

Step 1: Know Your Rights

The first step in obtaining your free credit score and report is understanding your rights as a consumer. According to federal law, you’re entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every year. You can request these reports by visiting AnnualCreditReport.com, the only authorized website for free credit reports.

Once you’ve requested your reports, the credit bureaus are required to provide them to you within 45 days. You can choose to receive all three reports at once or stagger them throughout the year.

The Benefits of Knowing Your Credit Score and Report

Knowing your credit score and report is crucial for financial planning. Your credit score is a three-digit number that serves as a snapshot of your creditworthiness. Lenders, credit card companies, and other financial institutions use this number to determine whether you’re a high-risk borrower or not. A higher credit score typically means better interest rates and more favorable loan terms.

Your credit report, on the other hand, is a detailed summary of your financial history. It includes information on your credit accounts, payment history, and debt balances. Reviewing your credit report can help you catch errors or fraudulent activity and improve your credit standing.

Step 2: Request Your Free Credit Report

To request your free credit report, visit AnnualCreditReport.com and provide your personal information, including your name, address, and Social Security number. You’ll also be prompted to answer some security questions to verify your identity.

Once you’ve completed the verification process, you’ll be able to view and download your credit report. Review the report carefully for any errors or inaccuracies.

The Difference Between Credit Reports and Credit Scores

It’s important to note that your credit report and credit score are not the same thing. Your credit report is a detailed summary of your financial history, while your credit score is a numerical representation of that history.

Your credit score is calculated based on factors such as your payment history, credit utilization, and length of credit history. Each credit bureau uses its own scoring model to calculate your score, so it may vary slightly between bureaus.

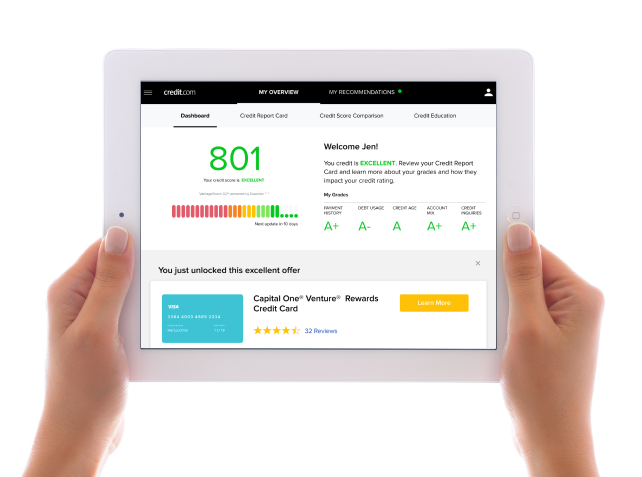

Step 3: Get Your Free Credit Score

While your credit report is free once a year, your credit score is not. However, many credit card companies and banks offer free credit scores to their customers. You can also use free credit score websites like Credit Karma or Credit Sesame to access your score.

It’s important to note that the credit score you receive from these sites may not be the same as the one lenders use. However, it can still give you a good idea of where you stand financially and how you can improve your credit standing.

The Benefits of Monitoring Your Credit Score

Monitoring your credit score can help you catch potential issues before they become a problem. For example, if you notice your score has dropped significantly, it could be a sign of fraudulent activity or identity theft. Monitoring your score regularly can help you catch these issues early and take action to protect your finances.

Step 4: Understand Your Credit Report

Once you’ve obtained your credit report, it’s important to understand what you’re looking at. Your report will include information on your credit accounts, payment history, and debt balances. It may also include information on any public records, such as bankruptcies or liens.

Review your report carefully for any errors or inaccuracies. If you notice any mistakes, contact the credit bureau to dispute them.

The Benefits of Regularly Checking Your Credit Report

Regularly checking your credit report can help you catch errors or fraudulent activity early. It can also give you a better understanding of your financial history and how you can improve your credit standing.

Step 5: Take Steps to Improve Your Credit Score

If you’re not happy with your credit score, there are steps you can take to improve it. Paying your bills on time, keeping your credit utilization low, and avoiding opening too many new credit accounts can all help improve your score over time.

It’s also important to review your credit report regularly for any errors or inaccuracies that may be impacting your score. Disputing these errors can help improve your score and overall financial health.

Credit Score Vs. Credit Report

Your credit score and credit report are both important tools for understanding your financial health. Your credit report provides a detailed summary of your financial history, while your credit score is a numerical representation of that history. Regularly checking both can help you catch errors or fraudulent activity, improve your credit standing, and achieve your financial goals.

Frequently Asked Questions

Knowing your credit score is important for your financial health. A good credit score can help you get approved for loans and credit cards with favorable terms. Here are some common questions about how to get your free credit score and report.

What is a credit score and report?

A credit score is a three-digit number that represents your creditworthiness. It is based on your credit history and can range from 300 to 850. A credit report is a detailed record of your credit history that includes information about your credit accounts, payment history, and public records. It is used by lenders to evaluate your creditworthiness.

You can get your credit score and report for free from several sources, including credit bureaus, credit card companies, and other financial institutions. It is important to check your credit score and report regularly to ensure that the information is accurate and up-to-date.

How can I get my free credit score and report?

You can get your free credit score and report from several sources, including AnnualCreditReport.com, which is the only website authorized by the federal government to provide free credit reports. You can also get your credit score and report for free from some credit card companies and financial institutions. It is important to check your credit report from all three credit bureaus (Equifax, Experian, and TransUnion) to ensure that the information is accurate and up-to-date.

Keep in mind that some websites may offer a “free” credit score or report but may require you to sign up for a trial subscription or provide your credit card information. Be sure to read the terms and conditions carefully and cancel any subscriptions before the trial period ends to avoid being charged.

How often should I check my credit score and report?

You should check your credit score and report at least once a year to ensure that the information is accurate and up-to-date. You may want to check more often if you’re planning to apply for a loan or credit card in the near future. Checking your credit score and report regularly can also help you detect and correct errors or fraudulent activity.

Keep in mind that checking your credit score or report does not affect your credit score. This is known as a “soft” inquiry and is not visible to lenders. However, applying for credit or loans can result in a “hard” inquiry, which can affect your credit score.

What factors affect my credit score?

Several factors can affect your credit score, including your payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. Payment history and credit utilization are the most important factors, accounting for about 65% of your credit score. It is important to make payments on time and keep your credit utilization low to maintain a good credit score.

Other factors that can affect your credit score include public records such as bankruptcies, collections, and judgments. These negative marks can stay on your credit report for up to 10 years and can have a significant impact on your credit score.

What should I do if I find errors on my credit report?

If you find errors on your credit report, you should dispute them with the credit bureau that issued the report. You can do this online, by phone, or by mail. The credit bureau is required to investigate your dispute and correct any errors within 30 days. You should also contact the creditor or lender that reported the incorrect information to ensure that they correct the error on their end.

Keep in mind that it may take several weeks or months for the credit bureaus to correct errors on your credit report. It is important to be patient and persistent in following up with them to ensure that the errors are corrected.

In conclusion, getting your free credit score and report is an essential step in managing your finances. By regularly checking your credit report, you can identify any errors, track your progress, and make informed decisions about your credit. Remember, your credit score is not set in stone, and there are many ways you can improve it over time.

To get started, you can visit one of the many online resources that offer free credit scores and reports. Some popular options include Credit Karma, Credit Sesame, and AnnualCreditReport.com. These sites will provide you with a detailed breakdown of your credit history, including your payment history, credit utilization, and outstanding debts.

Overall, taking control of your credit score is a crucial step towards achieving financial stability and security. Whether you are looking to buy a home, qualify for a loan, or simply improve your overall financial health, knowing your credit score and report is an essential first step. So why wait? Get started today and take control of your financial future!

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)