All About Credit Cards: Types, Benefits, And How To Choose The Right One

Credit cards have become a ubiquitous part of modern life, offering a convenient way to pay for purchases both big and small. But with so many options available, it can be overwhelming to choose the right one. In this guide, we’ll explore the different types of credit cards, their benefits, and how to select the best one for your needs. Whether you’re new to credit or a seasoned user, this article will provide valuable insights to help you make informed decisions about your finances. So, let’s dive in and learn all about credit cards!

Credit cards come in different types, including balance transfer, rewards, secured, and unsecured. Each type has its own benefits such as lower interest rates, cashback rewards, and credit building opportunities. To choose the right credit card, consider your spending habits, credit score, and the card’s fees and rewards. Compare different credit cards and select the one that best suits your needs and financial situation.

All About Credit Cards: Types, Benefits, and How to Choose the Right One

Credit cards have become an essential part of our daily lives, allowing us to make purchases and pay for services with ease. However, with so many credit cards available in the market, choosing the right one can be overwhelming. In this article, we will discuss the types of credit cards, their benefits, and how to choose the right one for you.

Types of Credit Cards

There are various types of credit cards available in the market, each designed to cater to different needs. Here are some of the most common types of credit cards:

1. Rewards Credit Cards

Rewards credit cards offer various perks and benefits in the form of points, cashback, or miles. The rewards are earned when you use your credit card to make purchases. These rewards can be redeemed for various things, such as travel, merchandise, gift cards, or statement credit.

2. Cashback Credit Cards

Cashback credit cards are a type of rewards credit card that offer cashback on purchases made with the card. The percentage of cashback varies from card to card and can range from 1% to 5%. Some cashback credit cards also offer sign-up bonuses, which can earn you a significant amount of cashback.

3. Balance Transfer Credit Cards

Balance transfer credit cards allow you to transfer high-interest balances from other credit cards to a new credit card with a lower interest rate. This can help you save money on interest charges and pay off your debt faster. However, balance transfer credit cards often come with a balance transfer fee, which can range from 3% to 5% of the total amount transferred.

4. Secured Credit Cards

Secured credit cards are designed for people with little or no credit history or those with poor credit. These cards require a security deposit, which is used as collateral in case you default on your payments. Secured credit cards often have lower credit limits and higher interest rates than traditional credit cards.

Benefits of Credit Cards

Credit cards offer several benefits, including:

1. Convenience

Credit cards allow you to make purchases without carrying cash. This can be especially helpful when traveling or making large purchases.

2. Rewards and Cashback

As mentioned earlier, rewards and cashback credit cards offer various perks and benefits.

3. Building Credit

Using a credit card responsibly can help you build your credit history, which can be helpful when applying for loans or mortgages in the future.

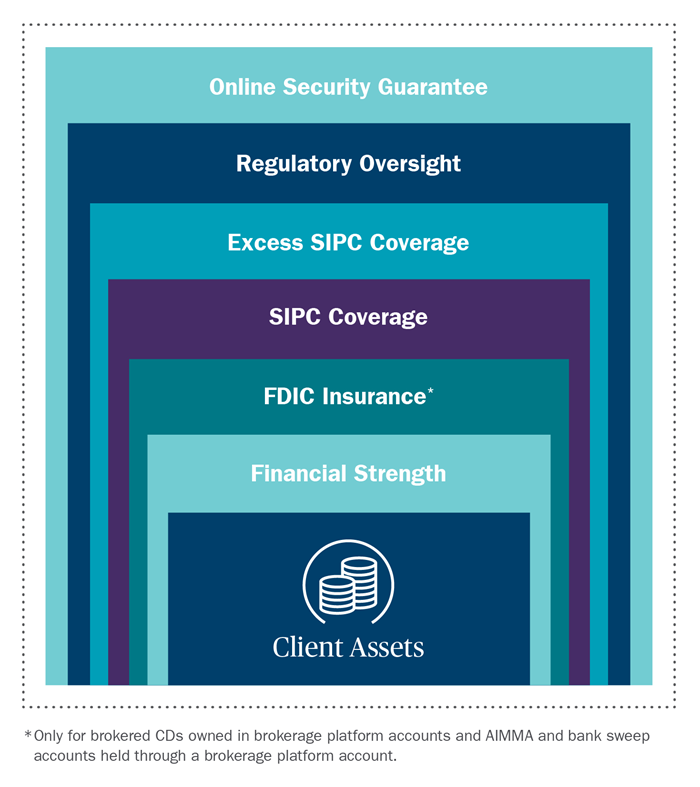

4. Fraud Protection

Credit cards offer protection against fraud and unauthorized purchases. If your credit card is stolen or used without your permission, you can dispute the charges and get your money back.

How to Choose the Right Credit Card

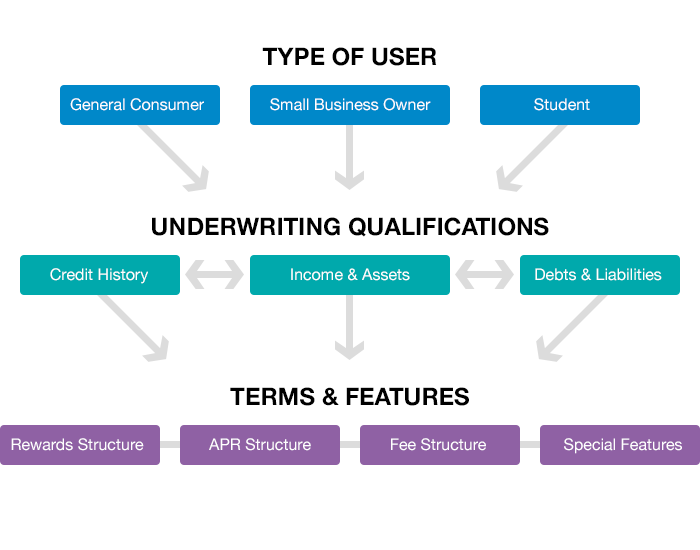

Choosing the right credit card depends on your personal preferences and financial situation. Here are some factors to consider:

1. Your Credit Score

Your credit score plays a significant role in determining which credit cards you are eligible for. If you have a good credit score, you may qualify for rewards credit cards with low-interest rates and high credit limits.

2. Your Spending Habits

Consider your spending habits when choosing a credit card. If you spend a lot on groceries or gas, look for a credit card that offers rewards or cashback on those purchases.

3. Fees and Interest Rates

Be sure to read the fine print and understand the fees and interest rates associated with the credit card. Look for a credit card with no annual fee and a low-interest rate.

4. Rewards and Benefits

Consider the rewards and benefits offered by the credit card. If you travel frequently, look for a credit card that offers travel rewards or perks such as airport lounge access.

5. Customer Service

Lastly, consider the customer service provided by the credit card company. Look for a company with a good reputation for customer service and support.

In conclusion, credit cards can be a useful financial tool when used responsibly. Consider the types of credit cards available, their benefits, and how to choose the right one for your needs. Remember to use your credit card wisely and pay off your balance in full each month to avoid high-interest charges and debt.

Frequently Asked Questions

What are the different types of credit cards available?

Credit cards come in different types, such as rewards cards, balance transfer cards, secured cards, and student cards. Rewards cards offer bonuses and points when you use them to make purchases. Balance transfer cards allow you to transfer your debt from one credit card to another with a lower interest rate. Secured cards require a deposit and are ideal for those with poor credit scores. Student cards are designed for students with limited credit history and offer rewards and benefits.

When choosing a credit card, consider your spending habits, credit score, and financial goals. Choose the type of card that suits your needs and helps you achieve your financial objectives.

What are the benefits of owning a credit card?

Credit cards offer several benefits, including convenience, rewards, and protection. You can use your credit card to make purchases online, over the phone, or in-store without carrying cash. Many credit cards offer rewards programs that give you points for each dollar you spend. You can redeem these points for travel, cash back, or other rewards. Credit cards also offer protection against fraud and unauthorized purchases.

However, owning a credit card also comes with responsibilities. You need to pay your bills on time and manage your debt effectively to avoid high interest rates and fees.

How do I choose the right credit card?

When choosing a credit card, consider your spending habits, credit score, and financial goals. Look for a card with a low interest rate, no annual fees, and rewards that match your spending. If you plan to carry a balance, choose a card with a low APR. If you travel frequently, look for a card with travel rewards and no foreign transaction fees.

Compare different credit card offers and read the fine print before you apply. Consider the credit limit, interest rates, fees, and rewards. Choose the card that best meets your needs and helps you achieve your financial goals.

What factors influence my credit card application?

Credit card companies consider several factors when reviewing your application, including your credit score, income, and debt-to-income ratio. Your credit score is a measure of your creditworthiness and indicates how likely you are to repay your debt. A high credit score increases your chances of approval and may qualify you for lower interest rates and higher credit limits.

Your income and debt-to-income ratio also play a role in the approval process. Credit card companies want to ensure that you have the financial means to repay your debt. They may also consider your employment status, length of employment, and other factors.

What should I do if I have trouble paying my credit card bill?

If you have trouble paying your credit card bill, contact your credit card issuer as soon as possible. They may be able to offer you a payment plan or other options to help you manage your debt. Avoid missing payments or paying late, as this can damage your credit score and result in high interest rates and fees.

Consider seeking help from a credit counselor or financial advisor if you are struggling with debt. They can provide you with advice and resources to help you manage your debt and improve your financial situation.

Credit Cards 101 (Credit Card Basics 1/3)

In conclusion, credit cards can be a powerful tool for managing your finances and building your credit score. With so many different types of credit cards available, it’s important to do your research and choose the right one for your needs. Whether you’re looking for cash back rewards, travel perks, or a low interest rate, there’s a credit card out there that will work for you.

When choosing a credit card, it’s important to consider your spending habits and financial goals. Look for a card with rewards and benefits that align with your lifestyle, and make sure you understand the fees and interest rates associated with the card. With responsible use, a credit card can help you achieve your financial goals and build a strong credit history.

In summary, credit cards offer a variety of benefits and rewards for consumers. By choosing the right card and using it responsibly, you can take advantage of cash back rewards, travel perks, and other benefits while building your credit score. So whether you’re a seasoned credit card user or just starting out, take the time to explore your options and find the perfect card for your needs.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)