Top Ways To Boost Your Approval Odds For Credit Card Application

Applying for a credit card can be a daunting task, especially if you’re unsure about your approval odds. However, there are several ways you can increase your chances of getting approved for the credit card you want. In this article, we will explore the top ways to boost your approval odds for credit card applications, from improving your credit score to choosing the right credit card for your needs. So, if you want to increase your chances of getting approved for that dream credit card, read on!

1. Check your credit report and score to ensure accuracy and identify areas to improve.

2. Pay down existing debts and keep credit utilization low.

3. Choose a card that matches your credit profile and apply for cards with high approval odds.

4. Provide accurate and complete information on your application.

5. Consider a secured credit card or a co-signer if necessary.

6. Wait at least six months between credit card applications to avoid multiple hard inquiries on your credit report.

Top Ways to Boost Your Approval Odds for Credit Card Application

Are you planning to apply for a credit card? Whether you’re a first-timer or a seasoned cardholder, it’s always important to know how to increase your chances of getting approved. Here are the top ways to boost your approval odds for a credit card application.

1. Check Your Credit Score

Your credit score is one of the main factors that credit card issuers consider when evaluating your application. Before you apply, make sure to check your credit score and review your credit report for any errors or discrepancies. You can get a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at AnnualCreditReport.com.

If you have a high credit score (above 700), you’re more likely to get approved for credit cards with better rewards and lower interest rates. If your credit score is lower, you may still be able to get approved for a credit card, but you may have to pay higher fees and interest rates.

2. Choose the Right Card

Not all credit cards are created equal. Before you apply, research different credit cards and choose one that best fits your needs and credit profile. If you have a low credit score, look for credit cards that are designed for people with bad credit or no credit. If you have a high credit score, consider credit cards with better rewards and perks.

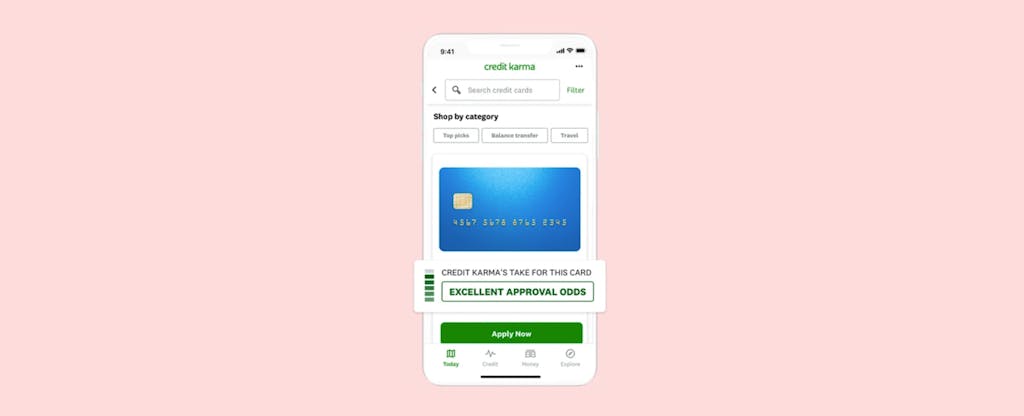

3. Apply for Pre-Approved Offers

If you’re not sure which credit card to apply for, you can check if you’re pre-approved for any credit card offers. Credit card issuers often send pre-approved offers to people who meet certain criteria, such as having a good credit score or a history of responsible credit use.

If you receive a pre-approved offer, it means that the credit card issuer has already reviewed your credit profile and determined that you’re a good candidate for the card. Applying for pre-approved offers can increase your chances of getting approved for a credit card.

4. Improve Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is the percentage of your monthly income that goes towards paying off debt. Credit card issuers look at your DTI to assess your ability to repay your debt. If your DTI is too high, it can hurt your chances of getting approved for a credit card.

To improve your DTI, try to pay off some of your debt or increase your income. You can also consider applying for a credit card with a higher credit limit, which can help lower your DTI.

5. Provide Accurate Information

When you apply for a credit card, make sure to provide accurate and truthful information. Any false or misleading information can result in your application being denied or your account being closed. Make sure to double-check your application before submitting it to avoid any mistakes.

6. Have a Stable Income

Credit card issuers want to know that you have a stable source of income to repay your debt. If you’re employed, make sure to provide your most recent pay stubs or tax returns. If you’re self-employed, provide your business income and tax returns.

If you don’t have a stable source of income, you may still be able to get approved for a credit card by providing proof of other sources of income, such as alimony or child support.

7. Don’t Apply for Multiple Cards at Once

Applying for multiple credit cards at once can hurt your credit score and decrease your chances of getting approved for any of the cards. Each time you apply for a credit card, the credit card issuer will perform a hard inquiry on your credit report, which can lower your credit score.

Instead of applying for multiple cards at once, research different credit cards and choose the one that best fits your needs and credit profile.

8. Pay Your Bills on Time

Paying your bills on time is one of the most important factors that credit card issuers consider when evaluating your application. Late payments can hurt your credit score and decrease your chances of getting approved for a credit card.

To avoid late payments, set up automatic payments or reminders for your bills. If you’re struggling to make payments, contact your creditors to discuss your options.

9. Reduce Your Credit Utilization Ratio

Your credit utilization ratio is the percentage of your available credit that you’re currently using. A high credit utilization ratio can hurt your credit score and decrease your chances of getting approved for a credit card.

To improve your credit utilization ratio, try to pay off some of your debt or increase your credit limit. You can also consider applying for a credit card with a higher credit limit, which can help lower your credit utilization ratio.

10. Consider a Secured Credit Card

If you have bad credit or no credit, you may still be able to get approved for a credit card by applying for a secured credit card. A secured credit card requires a security deposit, which serves as collateral for the credit card issuer. The credit limit is usually equal to the amount of the security deposit.

Using a secured credit card responsibly can help you build or rebuild your credit score and increase your chances of getting approved for a traditional credit card in the future.

In conclusion, applying for a credit card can be a daunting task, but by following these top ways to boost your approval odds, you can increase your chances of getting approved for the credit card that best fits your needs and credit profile.

Frequently Asked Questions

What are the top ways to boost your approval odds for credit card application?

There are several ways to increase your chances of getting approved for a credit card. Firstly, make sure you have a good credit score by paying your bills on time and keeping your credit utilization low. Secondly, choose a card that matches your credit profile and income level. Thirdly, provide accurate and complete information on your application form. Fourthly, consider applying for a secured credit card if you have a limited or poor credit history. Finally, consider adding a co-signer with a good credit score if you’re struggling to get approved on your own.

Overall, being responsible with your finances and demonstrating your creditworthiness will greatly improve your chances of getting approved for a credit card.

How can I improve my credit score before applying for a credit card?

If you have a low credit score, there are several steps you can take to improve it before applying for a credit card. Firstly, pay your bills on time and in full each month to avoid late fees and interest charges. Secondly, reduce your credit utilization by paying down your balances or requesting a credit limit increase. Thirdly, check your credit report for errors and dispute any inaccuracies with the credit bureau. Fourthly, avoid opening new credit accounts or applying for credit unnecessarily. Finally, consider using a credit monitoring service to track your progress and identify areas for improvement.

Remember, improving your credit score takes time and effort, but the benefits are well worth it. A higher credit score will not only increase your chances of getting approved for a credit card, but also qualify you for better interest rates and loan terms in the future.

Why is it important to choose a credit card that matches my credit profile?

Choosing a credit card that matches your credit profile is important because it increases your chances of getting approved and getting the best possible interest rate and rewards. For example, if you have a limited or poor credit history, you may have to start with a secured credit card that requires a deposit to establish your creditworthiness. On the other hand, if you have a good or excellent credit score, you may qualify for a premium card with generous rewards and perks. By choosing a card that matches your credit profile, you can avoid unnecessary rejections and protect your credit score from multiple hard inquiries.

Remember, applying for a credit card that’s beyond your credit level can do more harm than good. It’s better to start with a card that matches your credit profile and work your way up gradually as your credit improves.

What information do I need to provide on my credit card application form?

When you apply for a credit card, you’ll be asked to provide personal, financial, and employment information to help the issuer assess your creditworthiness. This may include your name, address, phone number, email, date of birth, social security number, gross annual income, monthly rent or mortgage payment, employment status, and other debts or assets. You may also be asked to provide additional information or documentation depending on the card issuer’s requirements.

It’s important to provide accurate and complete information on your application form to avoid delays or rejections. If you’re unsure about any details, don’t hesitate to contact the issuer or seek professional advice.

What should I do if my credit card application is denied?

If your credit card application is denied, don’t panic. There are several steps you can take to understand the reasons and improve your chances for the next time. Firstly, review the denial letter or email from the issuer to see if there were any specific reasons or factors that contributed to the decision. Secondly, check your credit report and score to see if there are any errors or issues that need to be addressed. Thirdly, consider applying for a secured credit card or a credit builder loan to establish or improve your credit history. Fourthly, wait for a few months and try applying for a different credit card that matches your credit profile and income level.

Remember, getting denied for a credit card is not the end of the world. With the right mindset and actions, you can turn it into an opportunity to learn and grow your creditworthiness.

In conclusion, boosting your approval odds for a credit card application is not a complicated process. By following these top ways, you can increase your chances of approval and enjoy the benefits of a credit card. Remember to check your credit score regularly, apply for cards that match your credit profile, and maintain a good credit utilization ratio. With a little effort, you can improve your financial standing and get the credit card you deserve. So, take the first step today and start on the path towards a better financial future.