How To Open A Bank Account: A Step-by-Step Guide

Opening a bank account can seem daunting, but it’s a crucial step in managing your finances. Whether you’re a student, a working professional, or a business owner, having a bank account allows you to save money, make transactions, and build credit. In this step-by-step guide, we’ll walk you through the process of opening a bank account, from choosing the right type of account to providing the necessary documents. So, let’s get started on your journey to financial stability and security!

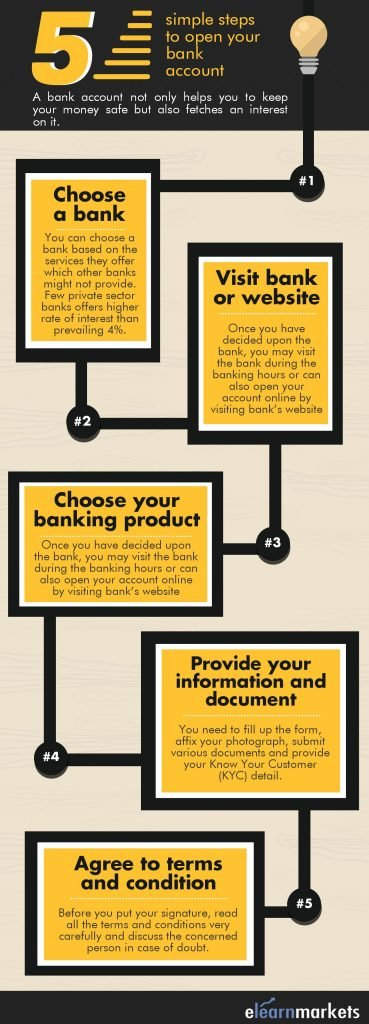

- Choose a bank that suits your needs and visit the nearest branch.

- Fill out the account opening form with your personal and financial details.

- Submit the required documents, including identity and address proof.

- Deposit the minimum required amount to activate the account.

- Receive your account details, including the account number and ATM card.

This step-by-step guide will help you to open a bank account hassle-free. Remember to choose the bank that offers the best interest rates, low fees, and convenient services to manage your money effectively.

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)

How to Open a Bank Account: A Step-by-Step Guide

Opening a bank account is a crucial step towards financial independence. It provides you with a secure place to keep your money, helps you build credit, and ensures easy access to loans and other financial products. However, the process of opening a bank account can be confusing for first-time applicants. In this guide, we’ll walk you through the steps involved in opening a bank account, from choosing the right bank to completing the application process.

Step 1: Choose the Right Bank

Before opening a bank account, you need to choose the right bank that meets your needs. Different banks offer different types of accounts, features, and benefits. You need to consider factors such as fees, interest rates, minimum balance requirements, ATM access, and online banking options. You can start by researching different banks online, comparing their offerings, and reading customer reviews. You can also ask your friends and family members for recommendations.

Once you have identified a few banks that seem suitable, you can visit their websites or branches to learn more about their products and services. You can also call or email their customer service representatives to clarify any doubts or concerns you may have. Some banks may require you to be a resident of a particular state or have a certain credit score to open an account.

Step 2: Choose the Right Type of Account

Once you have chosen a bank, you need to select the right type of account that suits your financial goals and needs. Most banks offer different types of accounts, such as savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs). You need to consider factors such as interest rates, fees, minimum balance requirements, and withdrawal limits.

If you want to save money for emergencies or future expenses, a savings account may be the right option for you. If you want to make transactions and pay bills, a checking account may be more suitable. If you want to earn higher interest rates, a money market account or CD may be the right choice.

Step 3: Gather Your Documents

Before you can open a bank account, you need to gather the necessary documents and information. Most banks require you to provide proof of identity, such as a driver’s license, passport, or national identity card. You may also need to provide proof of address, such as a utility bill, lease agreement, or bank statement. Some banks may also require you to provide your Social Security number or Tax Identification Number.

It’s a good idea to call the bank or check their website to learn about the specific documents and information required for opening an account. You can also ask if there are any special offers or promotions available for new customers.

Step 4: Complete the Application Form

Once you have gathered the necessary documents and information, you need to fill out the application form. Most banks offer online or paper applications that require you to provide personal and financial information, such as your name, address, date of birth, employment status, income, and assets. You may also need to indicate the type of account you want to open and the initial deposit amount.

It’s important to read the terms and conditions carefully before signing the application form. You should also ask any questions or clarify any doubts you may have with the bank representative.

Step 5: Fund Your Account

After you have completed the application form and submitted it to the bank, you need to fund your account. Most banks require you to make an initial deposit to activate your account. The amount of the initial deposit varies depending on the type of account and the bank’s policies. Some banks may also require you to maintain a minimum balance to avoid fees or earn interest.

You can fund your account by depositing cash, checks, or transferring funds from another account. You can do this by visiting the bank’s branch, using an ATM, or using online banking. Some banks may also offer mobile banking or remote check deposit options.

Step 6: Activate Your Account

Once you have funded your account, you need to activate it. This involves verifying your identity and providing any additional information or documents required by the bank. This may include setting up online banking, ordering checks, or applying for a debit card.

You may also need to sign some documents, such as a signature card or disclosure statement. Some banks may also require you to schedule an appointment with a bank representative to complete the activation process.

Step 7: Start Using Your Account

After you have activated your account, you can start using it for your financial needs. You can make deposits, withdrawals, transfers, and payments using the bank’s services. You can also monitor your account activity and track your balances using online or mobile banking.

It’s important to keep your account in good standing by maintaining a sufficient balance, avoiding overdrafts, and paying any fees or charges on time. You should also review your account statements regularly and report any errors or unauthorized transactions to the bank immediately.

Step 8: Explore Additional Services

In addition to basic banking services, many banks offer additional products and services that can help you manage your finances more effectively. These may include credit cards, loans, investment accounts, insurance, and financial planning services. You can explore these options based on your financial goals and needs.

It’s important to compare the fees, interest rates, and terms of these products and services before applying for them. You should also read the fine print and ask any questions or concerns you may have with the bank representative.

Step 9: Maintain Good Relationships with the Bank

Maintaining a good relationship with your bank can help you access better products and services and avoid potential problems. You can do this by communicating with the bank representative regularly, keeping your contact information updated, and following the bank’s policies and procedures.

You should also try to build your credit history by making timely payments, avoiding defaults, and using credit responsibly. This can help you qualify for better interest rates, loans, and other financial products in the future.

Step 10: Compare and Review Your Options Regularly

Finally, it’s important to compare and review your banking options regularly to ensure that you are getting the best value for your money. You can do this by checking your account statements, reviewing your fees and charges, and comparing the interest rates and benefits of different banks and accounts.

You can also ask your bank representative for a review of your account to identify any areas for improvement or savings. If you are not satisfied with your current bank or account, you can consider switching to a different bank or account that meets your needs better.

In conclusion, opening a bank account is an important step towards financial stability and growth. By following these steps and choosing the right bank and account, you can ensure that your money is safe, accessible, and working for you.

Frequently Asked Questions

What do I need to open a bank account?

To open a bank account, you will need to provide personal identification such as a driver’s license or passport. You will also need to provide proof of address such as a utility bill or lease agreement. In addition, you may need to provide information about your employment and income.

It’s important to check with the specific bank you plan to open an account with to determine their specific requirements. Some banks may require additional documents or information depending on the type of account you want to open.

What types of bank accounts are available?

There are several types of bank accounts available, including checking accounts, savings accounts, and money market accounts. Checking accounts are used for daily transactions such as paying bills and making purchases. Savings accounts are designed for storing money and earning interest over time. Money market accounts are similar to savings accounts but typically offer higher interest rates.

It’s important to research the different types of accounts available and determine which one is best for your financial needs and goals.

Can I open a bank account online?

Yes, many banks offer the option to open a bank account online. This can be a convenient option for those who may not have the time or ability to visit a physical branch. To open an account online, you will typically need to provide personal information and upload copies of your identification and proof of address.

It’s important to ensure that the online banking platform you use is secure and that you take steps to protect your personal information.

What fees are associated with bank accounts?

Fees associated with bank accounts can vary depending on the bank and the type of account you have. Common fees include monthly maintenance fees, overdraft fees, and ATM fees. Some banks may also charge fees for services such as wire transfers and foreign transactions.

Before opening a bank account, it’s important to review the fee schedule and determine if the fees are reasonable and fit within your budget.

How do I choose the right bank for me?

Choosing the right bank for you depends on your individual financial needs and goals. Factors to consider include the bank’s fees, interest rates, and customer service. You may also want to consider the bank’s location and accessibility.

It’s important to research different banks and compare their offerings before making a decision. It’s also a good idea to read reviews from other customers to get an idea of their experiences with the bank.

How to Open Your First Bank Account (Checking & Savings)

In conclusion, opening a bank account may seem like a daunting task, but with this step-by-step guide, it can be a breeze. Remember to research different banks and their offerings, gather all necessary documents, and choose the account type that best fits your needs. By following these steps, you can set yourself up for financial success and security.

Having a bank account can provide numerous benefits, including the ability to save money, make secure transactions, and build credit. It also allows you to access a variety of financial services, such as loans and credit cards. By taking the time to open a bank account, you can take control of your finances and work towards achieving your financial goals.

Lastly, it’s important to remember that while opening a bank account is a crucial step in managing your finances, it’s just the beginning. Be sure to regularly monitor your account, stay on top of fees and charges, and take advantage of any additional tools or resources offered by your bank. With these tips in mind, you can make the most out of your banking experience and set yourself up for financial success in the long run.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)