All About Banking: Services, Fees, And Choosing The Right Bank

Are you new to the world of banking? Or maybe you’re looking to switch to a new bank? Either way, it’s important to understand the services offered, the fees involved, and how to choose the right bank for your needs. In this article, we’ll delve into all things banking to help you make informed decisions and manage your finances effectively. So, let’s get started!

Choosing the right bank requires careful consideration of your financial needs, the services offered, and the fees charged. Some common banking services include checking and savings accounts, loans, and credit cards. When evaluating banks, compare their fees, interest rates, and account requirements to find the best fit for you. Take the time to research and ask questions to ensure you make an informed decision.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

All About Banking: Services, Fees, and Choosing the Right Bank

When it comes to banking, there are a lot of options out there. From online banks to traditional brick-and-mortar institutions, it can be difficult to know which one is right for you. In this article, we’ll take a look at the different services offered by banks, the fees you can expect to pay, and how to choose the right bank for your needs.

Services Offered by Banks

Banks offer a wide range of services to their customers. Here are some of the most common:

Checking Accounts: A checking account is a basic account that allows you to deposit and withdraw money, pay bills, and make purchases with a debit card.

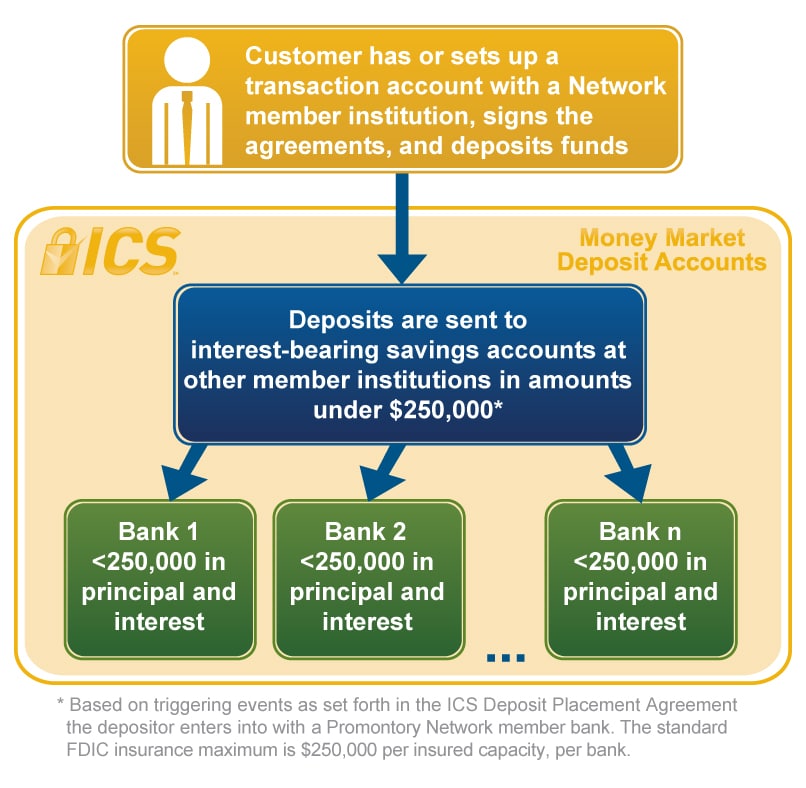

Savings Accounts: A savings account is a type of account that allows you to earn interest on your deposits. These accounts are often used to save for a specific goal, such as a down payment on a house.

Credit Cards: A credit card allows you to borrow money from the bank to make purchases. You’ll need to pay interest on the amount you borrow, so it’s important to use credit cards responsibly.

Loans: Banks offer a variety of loans, including personal loans, auto loans, and mortgages. These loans allow you to borrow money for a specific purpose and repay it over time.

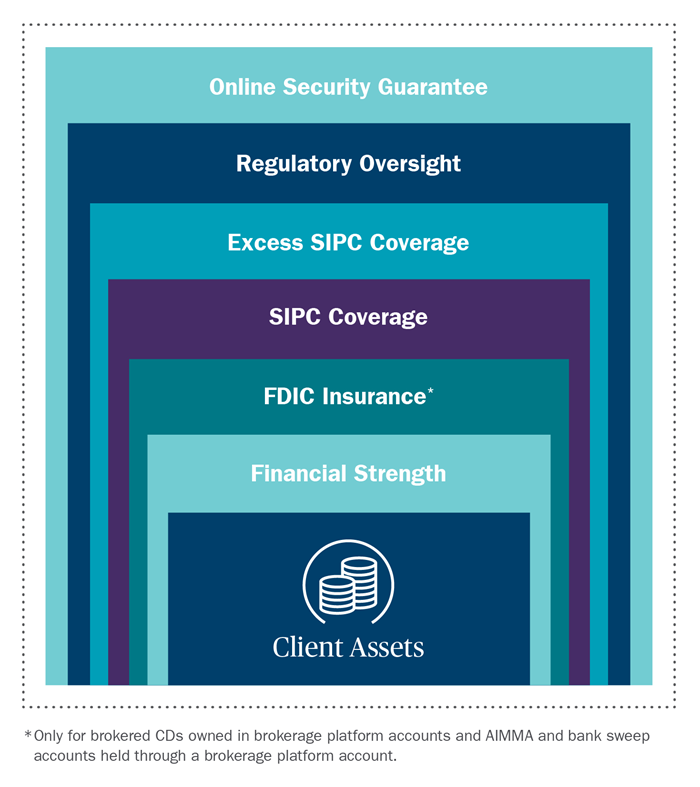

Investment Services: Some banks offer investment services, such as brokerage accounts and retirement accounts. These services allow you to invest your money in stocks, bonds, and other securities.

Fees to Expect

While banks offer a variety of services, they also charge fees for those services. Here are some of the most common fees you can expect to pay:

Monthly Maintenance Fees: Some banks charge a monthly fee for maintaining your account. This fee can range from a few dollars to several hundred dollars per year.

Overdraft Fees: If you spend more money than you have in your account, you’ll be charged an overdraft fee. This fee can be as high as $35 per transaction.

ATM Fees: If you use an ATM that doesn’t belong to your bank, you’ll be charged a fee. This fee can be as high as $5 per transaction.

Foreign Transaction Fees: If you use your debit or credit card outside of the United States, you’ll be charged a foreign transaction fee. This fee can be as high as 3% of the transaction amount.

Choosing the Right Bank

Choosing the right bank is important to ensure that you get the services you need without paying excessive fees. Here are some things to consider when selecting a bank:

Location: If you prefer to do your banking in person, you’ll want to choose a bank with branches near your home or workplace.

Online Services: If you prefer to do your banking online, look for a bank with a user-friendly website and mobile app.

Fees: Compare the fees charged by different banks to find one that offers the services you need at a reasonable price.

Customer Service: Look for a bank with good customer service, including helpful representatives and 24/7 support.

Extras: Some banks offer extra perks, such as rewards programs or discounts on other services. Consider these extras when choosing a bank.

In conclusion, banking is an important aspect of personal finance, and it’s important to choose the right bank for your needs. By understanding the services offered by banks, the fees you can expect to pay, and what to look for when choosing a bank, you can make an informed decision and find the best bank for your needs.

Frequently Asked Questions

In this section, we will answer some commonly asked questions about banking services, fees, and choosing the right bank.

What are some common banking services?

There are several common banking services that banks offer. These include checking accounts, savings accounts, loans, credit cards, and investment services. Checking accounts allow you to deposit and withdraw money easily, while savings accounts earn you interest on your balance. Loans can help you finance big purchases like a car or a home. Credit cards allow you to make purchases and earn rewards points or cash back. Investment services can help you grow your wealth by investing in stocks or bonds.

When choosing a bank, it’s important to consider what services you will need and how often you will use them. Some banks may specialize in certain services, so it’s important to do your research and find a bank that fits your needs.

What types of fees do banks charge?

Banks may charge several types of fees, including monthly maintenance fees, overdraft fees, ATM fees, and wire transfer fees. Monthly maintenance fees are charged for keeping your account open and can vary depending on the type of account you have. Overdraft fees are charged when you spend more money than you have in your account. ATM fees are charged for using an ATM that is not owned by your bank. Wire transfer fees are charged when you transfer money to another bank or person.

Before choosing a bank, it’s important to read the fine print and understand what fees they charge. Some banks may offer fee waivers or reimbursements for certain fees, so it’s important to ask about those options as well.

How can I choose the right bank?

Choosing the right bank can depend on several factors, including the services they offer, the fees they charge, and their customer service. It’s important to do your research and compare different banks before making a decision. You can start by looking at their website or visiting a branch to learn more about their services and fees. You can also read reviews or ask for recommendations from friends or family members.

When choosing a bank, it’s also important to consider your own needs and preferences. For example, if you travel frequently, you may want to choose a bank with a large ATM network or no foreign transaction fees. If you prefer to do your banking online, you may want to choose a bank with a user-friendly mobile app.

What should I look for in a checking account?

When looking for a checking account, there are several factors to consider. First, you should look at the fees associated with the account, including monthly maintenance fees and ATM fees. You should also consider the minimum balance required to avoid those fees. Second, you should look at the features of the account, such as overdraft protection and online bill pay. Finally, you should consider the bank’s customer service and reputation.

It’s important to choose a checking account that fits your needs and budget. If you frequently use ATMs, you may want to choose a bank with a large ATM network. If you prefer to do your banking online, you may want to choose a bank with a user-friendly mobile app.

How can I avoid paying fees?

There are several ways to avoid paying fees at your bank. First, you can choose a bank that offers fee waivers or reimbursements for certain fees. For example, some banks may waive monthly maintenance fees if you maintain a certain balance or if you have direct deposit set up. Second, you can avoid overdraft fees by keeping track of your account balance and setting up alerts for low balances. Third, you can avoid ATM fees by using ATMs that are owned by your bank or by getting cash back at a store. Finally, you can avoid wire transfer fees by using online payment services like PayPal or Venmo.

By being aware of the fees your bank charges and taking steps to avoid them, you can save money and make the most of your banking experience.

In conclusion, banking plays an important role in our financial lives. Whether it’s for personal or business needs, choosing the right bank and understanding its services and fees is crucial. It’s important to do your research and compare different banks to find the best fit for your needs.

When looking for a bank, consider the services they offer such as online banking, mobile banking, and ATM access. Additionally, make sure to carefully review the fees associated with each service to avoid any unexpected charges.

Remember, your bank should work for you and your financial goals. Don’t be afraid to ask questions and seek advice from professionals to make the best decisions for your financial future. With the right bank and knowledge of their services and fees, you can confidently manage your finances and achieve your financial goals.

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)