Are CDs FDIC Insured? Understanding The Protection For Your Investment

As the world becomes more digital, it’s easy to forget about the investments that we used to hold in our hands. CDs, or certificates of deposit, are one such investment that many people still hold onto. But what happens if the bank holding your CD goes under? Are your funds protected? In this article, we’ll explore whether CDs are FDIC insured and what that means for you as an investor.

When it comes to investing, it’s essential to understand the risks involved and how you can protect your money. The Federal Deposit Insurance Corporation, or FDIC, is an independent agency that provides insurance to protect depositors in case a bank fails. But does this protection extend to CDs? Keep reading to find out.

Certificates of Deposit (CDs) are FDIC insured, which means that the Federal Deposit Insurance Corporation (FDIC) will protect your investment up to $250,000 per depositor, per insured bank, for each account ownership category. This coverage helps protect your money in case the bank fails or goes out of business. It’s important to check that the bank you choose is FDIC insured and to stay within the insurance limits to keep your investment safe.

Are CDs FDIC Insured? Understanding the Protection for Your Investment

What is FDIC Insurance?

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that provides insurance coverage to depositors in the event that a bank fails. The FDIC was created in 1933 in response to the widespread bank failures that occurred during the Great Depression. Today, the FDIC insures deposits at more than 5,000 banks and savings associations in the United States.

FDIC insurance provides depositors with protection against the loss of their deposits if their bank fails. The insurance coverage limit is currently $250,000 per depositor, per insured bank, for each account ownership category. This means that if you have multiple accounts at one bank, such as a checking account and a CD, each account is insured up to $250,000.

Are CDs FDIC Insured?

Yes, certificates of deposit (CDs) are FDIC insured, just like other deposit accounts such as checking and savings accounts. This means that if your bank fails, the FDIC will provide insurance coverage up to the limit of $250,000 per depositor, per insured bank, for each account ownership category.

It is important to note that not all CDs are the same. Some CDs may be issued by banks that are not FDIC insured, such as brokered CDs. Brokered CDs are issued by banks and then sold by brokerage firms. If you are considering purchasing a CD, it is important to confirm that the issuing bank is FDIC insured.

CDs vs. Other FDIC-Insured Accounts

CDs offer a higher interest rate than traditional savings accounts, but they also require a longer commitment time. Savings accounts typically offer lower interest rates, but they allow depositors to withdraw funds at any time without penalty. Both CDs and savings accounts are FDIC insured up to $250,000 per depositor, per insured bank, for each account ownership category.

Checking accounts are also FDIC insured, but they typically do not earn interest. Like savings accounts, depositors can withdraw funds from checking accounts at any time without penalty.

Benefits of FDIC Insurance for CDs

FDIC insurance provides peace of mind for CD investors, knowing that their investment is protected up to the limit of $250,000 per depositor, per insured bank, for each account ownership category. This protection is especially important for those who rely on the income from their CDs for retirement or other long-term goals.

In addition, FDIC insurance is backed by the full faith and credit of the United States government, meaning that depositors can be confident in the safety of their investment even in times of economic uncertainty.

Conclusion

CDs are a popular investment option for those looking to earn a higher return on their savings. It is important to remember that not all CDs are FDIC insured, so it is important to confirm that the issuing bank is insured before investing. FDIC insurance provides peace of mind for CD investors, knowing that their investment is protected up to the limit of $250,000 per depositor, per insured bank, for each account ownership category.

Overall, understanding FDIC insurance and how it applies to CDs can help investors make informed decisions about their savings and investments. By choosing FDIC-insured CDs, investors can rest assured that their hard-earned money is safe and protected by the government.

Frequently Asked Questions

1. Are CDs FDIC insured?

Yes, CDs or certificates of deposit are FDIC insured. The Federal Deposit Insurance Corporation or FDIC insures CDs up to $250,000 per depositor, per bank. This means that if the bank where you have deposited your CD goes bankrupt or fails, your investment is protected up to $250,000. It is important to note that the FDIC insurance only covers the principal amount of your investment and not any interest earned.

However, not all types of CDs are FDIC insured. Brokered CDs, for example, are not directly insured by the FDIC. Instead, they are covered by the underlying bank that issues them. It is important to check with your broker or bank to ensure that your CD is FDIC insured.

2. How does FDIC insurance work for CDs?

FDIC insurance works by providing protection to depositors in the event that their bank fails. If your bank goes bankrupt, the FDIC will step in and reimburse you up to $250,000 for your deposit. This means that you will not lose your investment even if the bank fails.

It is important to note, however, that the FDIC insurance only covers the principal amount of your investment and not any interest earned. Additionally, if you have multiple accounts at the same bank, the FDIC insurance limit applies to the total amount of your deposits, not each individual account.

3. What are the requirements for FDIC insurance on CDs?

To be eligible for FDIC insurance, your CD must be issued by an FDIC-insured bank. The bank must also be in good standing with the FDIC and must meet certain regulatory requirements. Additionally, the amount of your CD must be within the FDIC insurance limit of $250,000 per depositor, per bank.

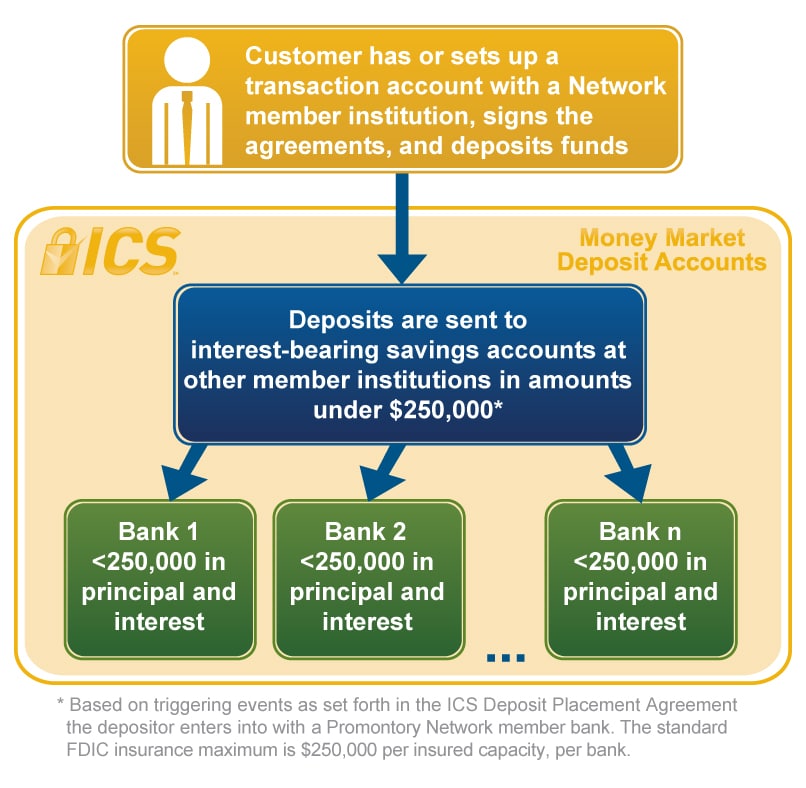

It is important to note that if you have multiple CDs at the same bank, the FDIC insurance limit applies to the total amount of your deposits, not each individual CD. If you have more than $250,000 in deposits at a single bank, you may want to consider spreading your investments across multiple banks or opening different types of accounts to maximize your FDIC insurance coverage.

4. Are CDs the only investments that are FDIC insured?

No, CDs are not the only investments that are FDIC insured. The FDIC also provides insurance coverage for other types of bank deposits, such as savings accounts, checking accounts, and money market accounts. The insurance limit for these types of accounts is also $250,000 per depositor, per bank.

It is important to note, however, that investment products such as stocks, bonds, and mutual funds are not FDIC insured. These types of investments carry different types of risks and do not offer the same level of protection as FDIC-insured bank deposits.

5. How can I maximize my FDIC insurance coverage for CDs?

To maximize your FDIC insurance coverage for CDs, you can spread your deposits across multiple banks or open different types of accounts. For example, you can invest in CDs at different banks to ensure that your total deposits are within the FDIC insurance limit.

Another option is to open joint accounts with other individuals. Joint accounts are insured up to $250,000 per co-owner, per bank. This means that if you open a joint CD with another person, you can double your FDIC insurance coverage for that deposit.

It is important to note that while maximizing your FDIC insurance coverage is important, it should not be the only factor to consider when investing in CDs. You should also consider the interest rate, maturity date, and other features of the CD before making a decision.

:max_bytes(150000):strip_icc()/FDIC_Seal_by_Matthew_Bisanz-b92facd3f0304834b33c305f7f9b2007.jpeg)

Understanding FDIC Insurance Coverage for CD’s, Bank Accounts and Other Deposits

In conclusion, it’s important to understand the protection for your investment when it comes to CDs. While CDs are not FDIC insured, they are often offered by FDIC-insured banks. This means that the bank itself is insured by the FDIC, but not necessarily the CD investment. It’s important to check with your bank and review the terms and conditions of the CD before investing.

Additionally, there are other ways to protect your investment in CDs. One option is to diversify your portfolio and invest in multiple CDs from different banks. This can help spread out your risk and ensure that you have protection in case one bank fails.

Finally, it’s important to remember that CDs are not the only investment option available. It’s important to do your research and consider other investment options that may offer FDIC insurance or other forms of protection. By being informed and making smart investment decisions, you can protect your money and achieve your financial goals.

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)