8 Best Student Loans Without A Cosigner For Financial Freedom

Student loans are a necessary evil for most students, but not everyone has the privilege of having a cosigner to help them out. Without a cosigner, getting a loan can be a daunting task, but it’s not impossible. In this article, we will explore the 8 best student loans without a cosigner to help you achieve financial freedom and pursue your academic dreams.

Whether you’re an international student or someone who doesn’t have anyone to cosign, this list will give you a range of options to choose from. From private lenders to government loans, we’ve got you covered. So, let’s dive in and explore the best student loans without a cosigner that can help you get the education you deserve.

- Sallie Mae

- Discover

- Ascent

- Funding U

- CommonBond

- College Ave

- Citizens Bank

- SoFi

These lenders offer competitive interest rates and flexible repayment options, making it easier for students to finance their education without requiring a cosigner. Start exploring your options today and find the best student loan for your needs.

8 Best Student Loans without a Cosigner for Financial Freedom

As a student, paying for college can be challenging, especially when you don’t have a cosigner to help you get a loan. Fortunately, there are several student loan options available that don’t require a cosigner. In this article, we’ve compiled a list of the eight best student loans without a cosigner to help you achieve financial freedom.

1. Discover Student Loans

Why We Like It: Discover Student Loans offers competitive rates, flexible repayment options, and cash rewards for good grades.

Who Should Get It: Students who want to earn cash rewards and flexible repayment options.

- Competitive interest rates

- No origination fees, application fees, or late fees

- Cash rewards for good grades

Pros:

- No fees

- Cash rewards for good grades

- Flexible repayment options

Cons:

- Requires good credit history

- May not cover the full cost of attendance

- No cosigner release option

2. Ascent Student Loans

Why We Like It: Ascent Student Loans offers flexible repayment options and allows students to apply without a cosigner.

Who Should Get It: International students and students without a cosigner.

- No cosigner required

- Flexible repayment options

- Interest rate reduction for automatic payments

Pros:

- No cosigner required

- Flexible repayment options

- Interest rate reduction for automatic payments

Cons:

- May require a higher interest rate without a cosigner

- May not cover the full cost of attendance

- No cosigner release option

3. Sallie Mae Student Loans

Why We Like It: Sallie Mae Student Loans offer fixed and variable interest rates, flexible repayment options, and a cosigner release option.

Who Should Get It: Students who want a cosigner release option and flexible repayment options.

- Fixed and variable interest rates available

- Cosigner release option

- Flexible repayment options

Pros:

- Cosigner release option

- Flexible repayment options

- Fixed and variable interest rates available

Cons:

- May require a higher interest rate without a cosigner

- May not cover the full cost of attendance

- Origination and late fees

4. College Ave Student Loans

Why We Like It: College Ave Student Loans offer flexible repayment options, competitive rates, and a cosigner release option.

Who Should Get It: Students who want flexible repayment options and a cosigner release option.

- Competitive interest rates

- Cosigner release option

- Flexible repayment options

Pros:

- Cosigner release option

- Flexible repayment options

- Competitive interest rates

Cons:

- May require a higher interest rate without a cosigner

- May not cover the full cost of attendance

- Origination and late fees

5. Citizens Bank Student Loans

Why We Like It: Citizens Bank Student Loans offer competitive rates, flexible repayment options, and a cosigner release option.

Who Should Get It: Students who want a cosigner release option and competitive rates.

- Competitive interest rates

- Cosigner release option

- Flexible repayment options

Pros:

- Cosigner release option

- Flexible repayment options

- Competitive interest rates

Cons:

- May require a higher interest rate without a cosigner

- May not cover the full cost of attendance

- Origination and late fees

6. Earnest Student Loans

Why We Like It: Earnest Student Loans offer flexible repayment options and allow borrowers to customize their loan terms.

Who Should Get It: Students who want to customize their loan terms and have flexible repayment options.

- Customizable loan terms

- Flexible repayment options

- No fees

Pros:

- Customizable loan terms

- Flexible repayment options

- No fees

Cons:

- May require a higher interest rate without a cosigner

- May not cover the full cost of attendance

- No cosigner release option

7. SoFi Student Loans

Why We Like It: SoFi Student Loans offer competitive rates, flexible repayment options, and career counseling services.

Who Should Get It: Students who want career counseling services and flexible repayment options.

- Competitive interest rates

- Career counseling services

- Flexible repayment options

Pros:

- Career counseling services

- Flexible repayment options

- Competitive interest rates

Cons:

- May require a higher interest rate without a cosigner

- May not cover the full cost of attendance

- No cosigner release option

8. CommonBond Student Loans

Why We Like It: CommonBond Student Loans offer competitive rates, flexible repayment options, and career counseling services.

Who Should Get It: Students who want career counseling services and flexible repayment options.

- Competitive interest rates

- Career counseling services

- Flexible repayment options

Pros:

- Career counseling services

- Flexible repayment options

- Competitive interest rates

Cons:

- May require a higher interest rate without a cosigner

- May not cover the full cost of attendance

- No cosigner release option

Frequently Asked Questions

Are you a student who is struggling to get a loan without a cosigner? Don’t worry, we’ve got you covered. Here are some frequently asked questions about student loans without a cosigner.

What are student loans without a cosigner?

Student loans without a cosigner are loans that are granted to students who do not have a cosigner. A cosigner is someone who signs the loan agreement with the student and is responsible for paying back the loan if the student is unable to do so. However, not all students have someone who is willing or able to cosign a loan for them. In these cases, students can apply for student loans without a cosigner.

These loans are typically available to students who have a good credit history or have a co-borrower who is willing to sign the loan agreement with them. The interest rates on these loans can be higher than those on loans with a cosigner, but they can be a good option for students who need financial assistance.

What are the best student loans without a cosigner?

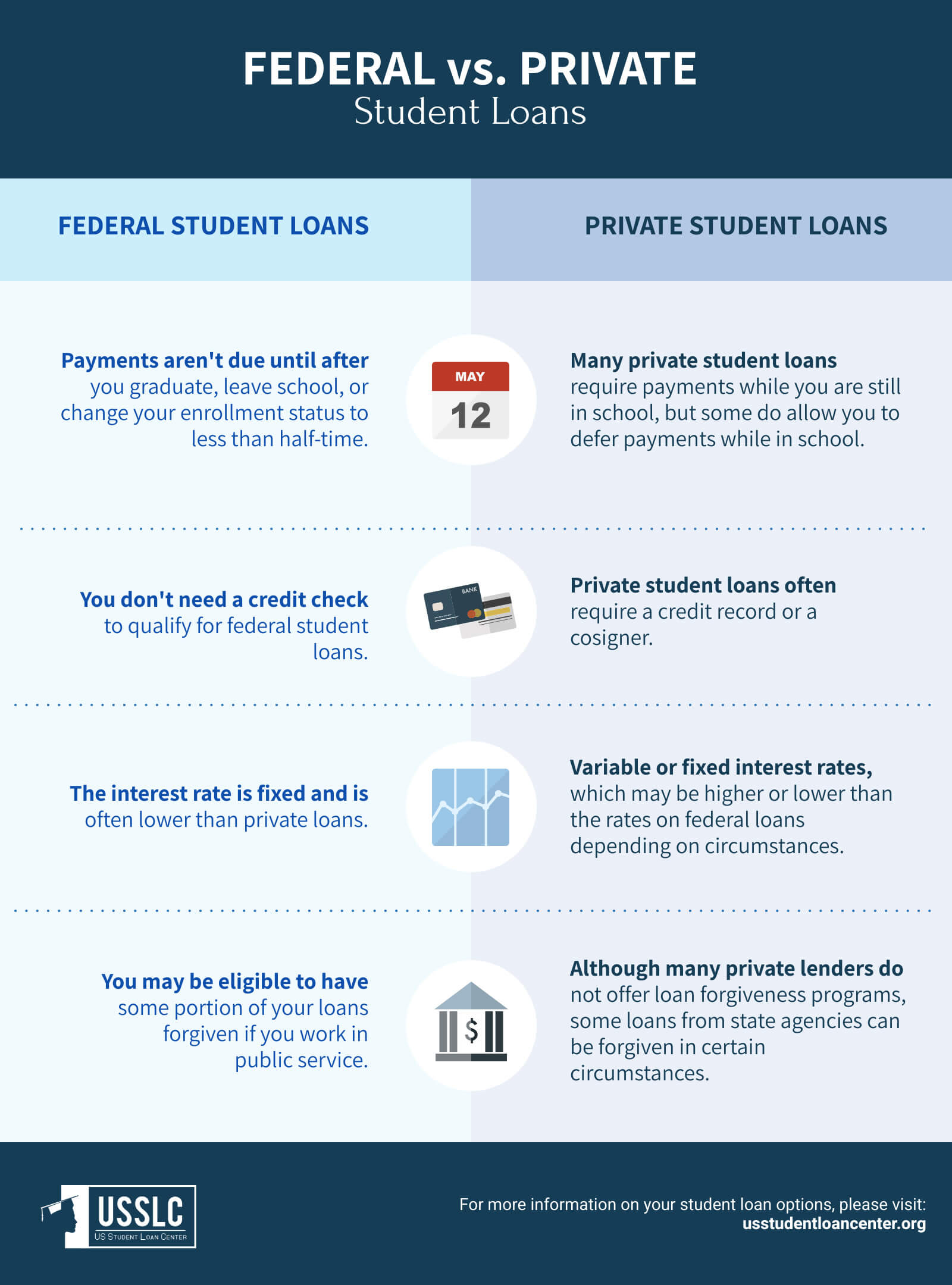

There are several student loans available for students who do not have a cosigner. Some of the best options include federal student loans, such as Direct Subsidized Loans and Direct Unsubsidized Loans. These loans do not require a cosigner or a credit check, and they offer flexible repayment options.

Other options include private student loans from lenders such as Discover, Sallie Mae, and Wells Fargo. These loans may require a cosigner or a good credit score, but they can offer competitive interest rates and flexible repayment terms.

How can I apply for student loans without a cosigner?

To apply for student loans without a cosigner, you will need to fill out a Free Application for Federal Student Aid (FAFSA). This form will determine your eligibility for federal student loans, grants, and work-study programs. If you are not eligible for federal aid, you can apply for private student loans from lenders.

When applying for private student loans, you will need to provide information about your income, credit score, and other financial information. Some lenders may require a cosigner, so it is important to research your options and find a lender that does not require a cosigner if possible.

What are the repayment options for student loans without a cosigner?

The repayment options for student loans without a cosigner will depend on the type of loan you have. Federal student loans offer several repayment options, including income-driven repayment plans, which allow you to make payments based on your income and family size.

Private student loans may offer a variety of repayment options as well, such as fixed or variable interest rates and different loan terms. It is important to research your options and choose a repayment plan that works for your budget and financial goals.

What are the risks of student loans without a cosigner?

One of the main risks of student loans without a cosigner is that the interest rates may be higher than those on loans with a cosigner. This can make it more difficult to pay back the loan in a timely manner and can result in higher overall costs.

In addition, if you are unable to make your loan payments, your credit score may be negatively impacted, which can make it more difficult to get loans or credit in the future. It is important to carefully consider your options and choose a loan that fits your financial situation and goals.

In today’s society, it is no secret that higher education can come with a hefty price tag. For students who do not have a cosigner or strong credit history, obtaining a student loan may seem like an impossible task. However, there are options available to help students achieve their dreams of higher education without the financial burden of a cosigner.

After conducting thorough research and analysis, we have compiled a list of the top 8 student loans available to students without a cosigner. These loans offer competitive interest rates, flexible repayment options, and most importantly, the financial freedom to pursue higher education without the added stress of a cosigner.

It is our hope that by providing this information, we can help students make informed decisions about their financial future and achieve their academic goals. By taking advantage of these resources, students can focus on their studies and pave the way for a brighter future. Remember, education is an investment in yourself, and with the right tools, you can achieve financial freedom and success.