8 Best Financial Advisors For Investment Planning

Investment planning can be a daunting task, especially if you are new to the world of finance. It’s always better to seek professional advice and guidance from financial advisors who can help you make informed decisions with your money. But with so many options out there, it can be overwhelming to choose the right advisor for your needs. That’s why we’ve compiled a list of the 8 best financial advisors for investment planning to simplify your search and help you make the most out of your investments.

- Charles Schwab

- Vanguard Personal Advisor Services

- Fidelity Investments

- Merrill Lynch Wealth Management

- Edward Jones

- Ameriprise Financial

- Morgan Stanley Wealth Management

- UBS Financial Services

These companies offer a range of investment services including portfolio management, retirement planning, and financial advice. Choosing the right financial advisor can make a big difference in achieving your investment goals. Consider factors such as fees, investment philosophy, and track record when making your decision.

8 Best Financial Advisors for Investment Planning

Investing your money is a crucial decision that requires careful planning and strategy. It is essential to work with a financial advisor who can provide you with expert advice and guidance to make informed decisions. In this article, we have compiled a list of the eight best financial advisors for investment planning to help you make the right choice.

1. Vanguard Personal Advisor Services

Why We Like It: Vanguard Personal Advisor Services is an excellent choice for investors who want a low-cost, long-term investment strategy. They offer a range of investment options, including exchange-traded funds (ETFs), mutual funds, and individual stocks and bonds. Their advisors also provide personalized investment advice based on your financial goals.

Who Should Get It: Investors who want a long-term investment strategy and are comfortable with a hands-off approach should consider Vanguard Personal Advisor Services. It is also suitable for those who prefer a low-cost investment option.

- Low-cost investment options

- Personalized investment advice

- Easy to use platform

- Pros:

- Low fees

- Passive investment approach

- Personalized investment advice

- Cons:

- Minimum investment requirement of $50,000

- Less hands-on approach

- May not be suitable for active traders

- Key Features:

- Wide range of investment options

- Access to financial planning tools and resources

- Excellent customer service

- Pros:

- Low fees

- Range of investment options

- Access to financial planning tools and resources

- Cons:

- May have higher fees for some investment options

- May not be suitable for beginners

- Minimum investment requirements for some accounts

- Key Features:

- Wide range of investment options

- Access to financial planning tools and resources

- Excellent customer service

- Pros:

- Low fees

- Range of investment options

- Access to financial planning tools and resources

- Cons:

- May have higher fees for some investment options

- May not be suitable for beginners

- Minimum investment requirements for some accounts

- Key Features:

- Low-cost investment options

- Access to financial planning tools and resources

- Easy to use platform

- Pros:

- Low fees

- Passive investment approach

- Access to financial planning tools and resources

- Cons:

- May not be suitable for active traders

- Less hands-on approach

- Minimum investment requirement of $100

- Key Features:

- Range of investment options

- Access to financial planning tools and resources

- Excellent customer service

- Pros:

- Personalized investment advice

- Access to financial planning tools and resources

- Range of investment options

- Cons:

- May have higher fees for some investment options

- Minimum investment requirement of $100,000

- May not be suitable for beginners

- Key Features:

- Low-cost investment options

- Access to financial planning tools and resources

- Easy to use platform

- Pros:

- Low fees

- Passive investment approach

- Access to financial planning tools and resources

- Cons:

- May not be suitable for active traders

- Less hands-on approach

- May not be suitable for those with a higher net worth

- Key Features:

- Wide range of investment options

- Access to financial planning tools and resources

- Excellent customer service

- Pros:

- Low fees

- Range of investment options

- Access to financial planning tools and resources

- Cons:

- May have higher fees for some investment options

- May not be suitable for beginners

- Minimum investment requirements for some accounts

- Key Features:

- Wide range of investment options

- Access to financial planning tools and resources

- Excellent customer service

- Pros:

- Low fees

- Range of investment options

- Access to financial planning tools and resources

- Cons:

- May have higher fees for some investment options

- May not be suitable for beginners

- Minimum investment requirements for some accounts

2. Charles Schwab

Why We Like It: Charles Schwab offers a range of investment options, including mutual funds, ETFs, individual stocks and bonds, and options trading. They also provide a range of financial planning tools and resources to help investors make informed decisions.

Who Should Get It: Investors who want a range of investment options and access to financial planning tools should consider Charles Schwab. It is also suitable for those who want to take a more hands-on approach to investing.

3. Fidelity Investments

Why We Like It: Fidelity Investments offers a range of investment options, including mutual funds, ETFs, individual stocks and bonds, and options trading. They also provide a range of financial planning tools and resources to help investors make informed decisions.

Who Should Get It: Investors who want a range of investment options and access to financial planning tools should consider Fidelity Investments. It is also suitable for those who want to take a more hands-on approach to investing.

4. Betterment

Why We Like It: Betterment offers a range of investment options, including ETFs and individual stocks and bonds. They also provide a range of financial planning tools and resources to help investors make informed decisions.

Who Should Get It: Investors who want a hands-off investment approach and access to financial planning tools should consider Betterment. It is also suitable for those who prefer a low-cost investment option.

5. Personal Capital

Why We Like It: Personal Capital offers a range of investment options, including ETFs, individual stocks and bonds, and alternative investments. They also provide a range of financial planning tools and resources to help investors make informed decisions.

Who Should Get It: Investors who want a hands-on approach to investing and access to financial planning tools should consider Personal Capital. It is also suitable for those who have a higher net worth.

6. Wealthfront

Why We Like It: Wealthfront offers a range of investment options, including ETFs and individual stocks and bonds. They also provide a range of financial planning tools and resources to help investors make informed decisions.

Who Should Get It: Investors who want a hands-off investment approach and access to financial planning tools should consider Wealthfront. It is also suitable for those who prefer a low-cost investment option.

7. TD Ameritrade

Why We Like It: TD Ameritrade offers a range of investment options, including mutual funds, ETFs, individual stocks and bonds, and options trading. They also provide a range of financial planning tools and resources to help investors make informed decisions.

Who Should Get It: Investors who want a range of investment options and access to financial planning tools should consider TD Ameritrade. It is also suitable for those who want to take a more hands-on approach to investing.

8. E-Trade

Why We Like It: E-Trade offers a range of investment options, including mutual funds, ETFs, individual stocks and bonds, and options trading. They also provide a range of financial planning tools and resources to help investors make informed decisions.

Who Should Get It: Investors who want a range of investment options and access to financial planning tools should consider E-Trade. It is also suitable for those who want to take a more hands-on approach to investing.

In conclusion, choosing the right financial advisor for investment planning is crucial to ensure the growth and security of your money. Each of the above-listed financial advisors offers unique features and benefits that cater to different investment needs and preferences. Consider your investment goals, risk tolerance, and budget while selecting the best financial advisor for you.

Frequently Asked Questions

Learn more about the best financial advisors for investment planning with these frequently asked questions.

What is investment planning?

Investment planning involves creating a strategy for allocating your assets in a way that maximizes returns while minimizing risk. A financial advisor can help you determine your financial goals and risk tolerance, and develop an investment plan that meets your needs.

Investment planning can involve a variety of asset classes, including stocks, bonds, mutual funds, and real estate. Your financial advisor will work with you to create a diversified investment portfolio that aligns with your goals and risk tolerance.

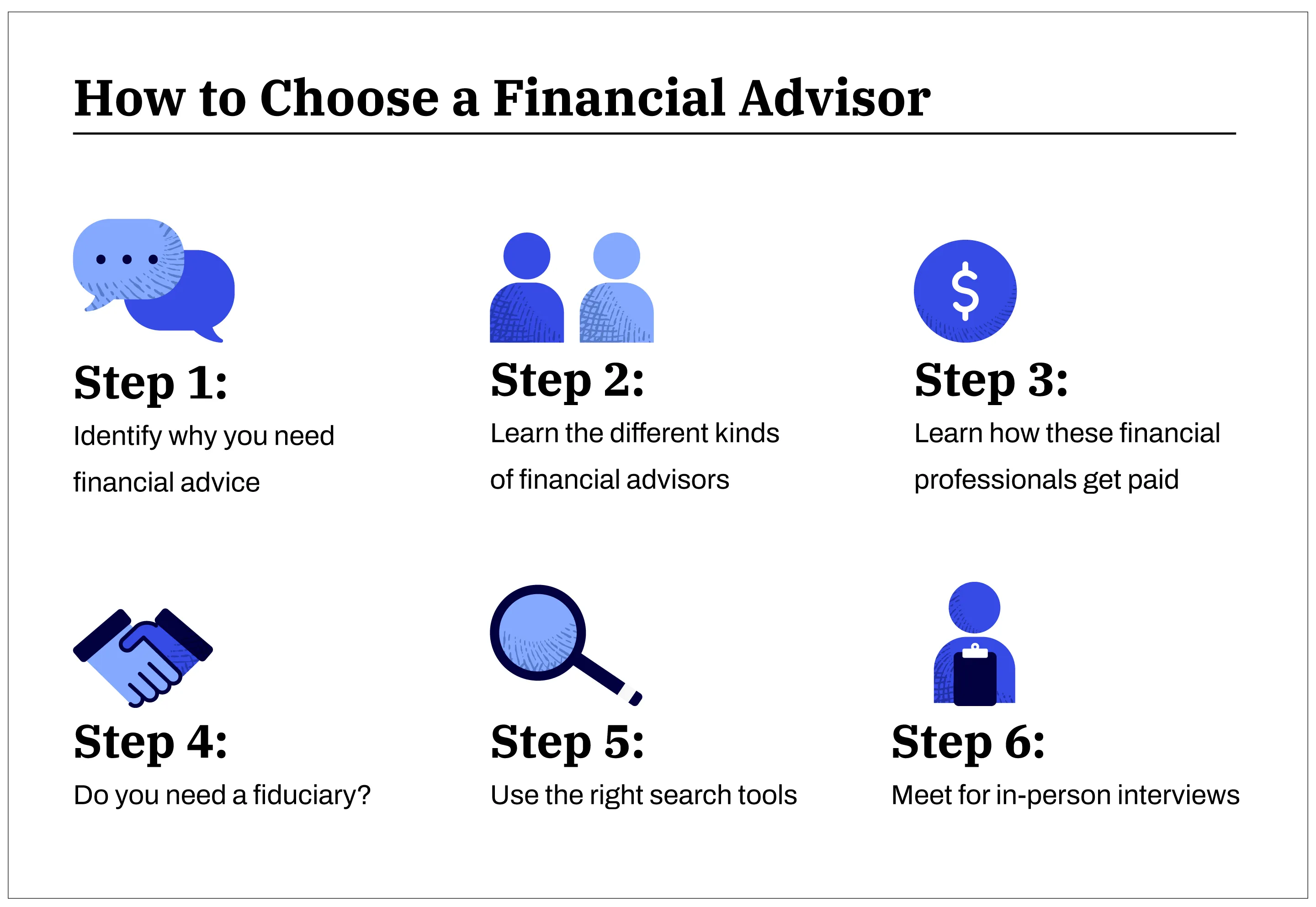

What should I look for in a financial advisor for investment planning?

When choosing a financial advisor for investment planning, it’s important to consider their credentials and experience. Look for advisors who hold certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), and who have a track record of success in helping clients achieve their financial goals.

You should also consider the advisor’s investment philosophy and whether it aligns with your own. A good advisor should be transparent about their approach to investing and should be able to explain their rationale for making investment decisions.

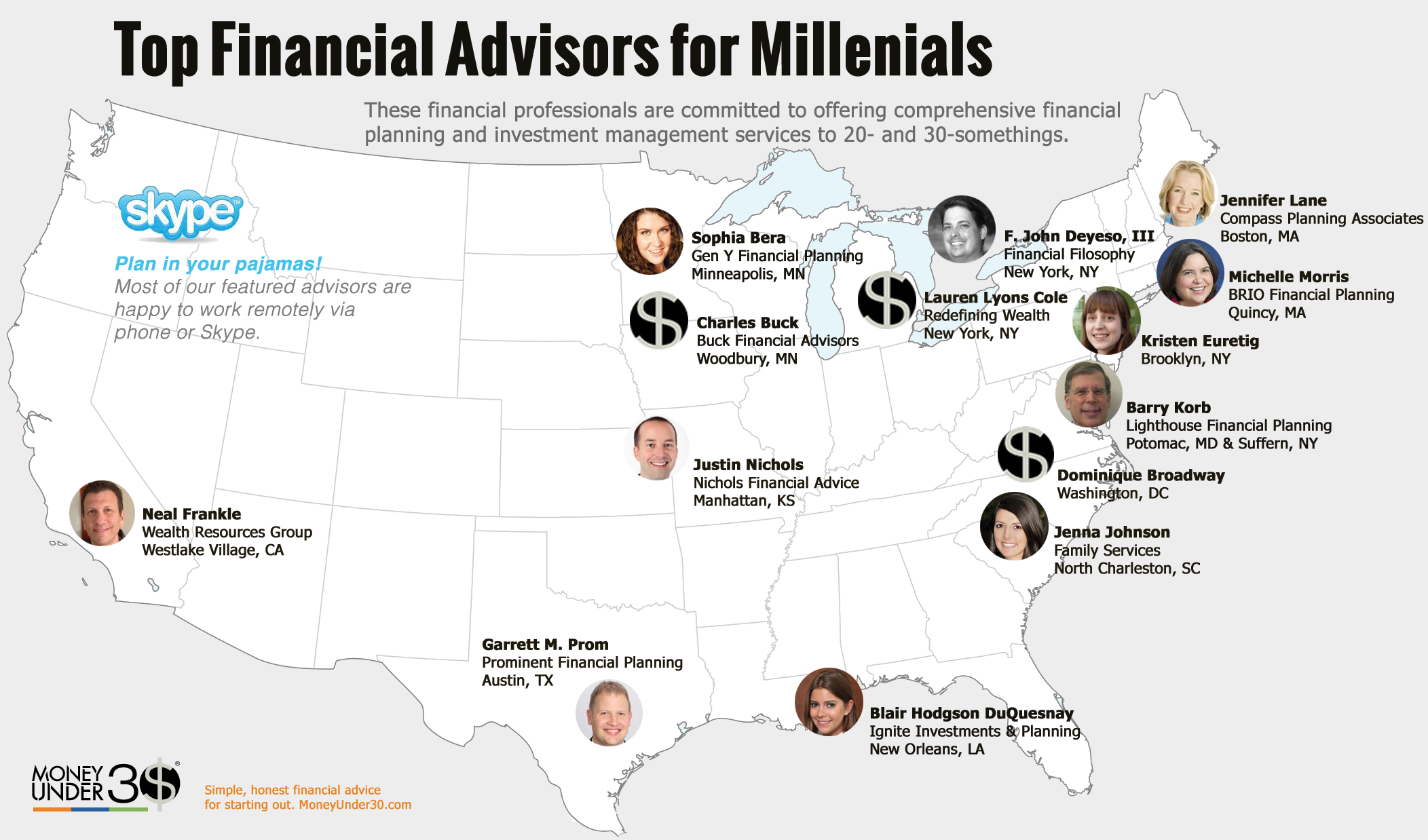

Who are the best financial advisors for investment planning?

There are many financial advisors who specialize in investment planning, but some of the best include Vanguard Personal Advisor Services, Charles Schwab Intelligent Portfolios, Betterment, Personal Capital, and Fidelity Go. These advisors offer a range of services, including automated investing platforms and personalized advice from human advisors.

When choosing a financial advisor, it’s important to do your research and compare the services and fees of different advisors to find the one that best meets your needs.

How much does it cost to work with a financial advisor for investment planning?

The cost of working with a financial advisor for investment planning can vary depending on the advisor and the services they offer. Some advisors charge a flat fee or hourly rate, while others charge a percentage of the assets they manage.

On average, you can expect to pay between 1% and 2% of your assets under management per year for investment planning services. However, some advisors may charge less or more depending on the complexity of your financial situation and the level of service you require.

Why is it important to work with a financial advisor for investment planning?

Working with a financial advisor for investment planning can help you achieve your financial goals and ensure that your investment portfolio is aligned with your risk tolerance and investment objectives. A good advisor can also help you navigate changing market conditions and make adjustments to your investment strategy as needed.

Investment planning can be complex and time-consuming, and a financial advisor can provide the expertise and guidance you need to make informed investment decisions. By working with an advisor, you can have peace of mind knowing that your investments are being managed by a professional who has your best interests in mind.

In today’s complex financial world, it can be challenging to make informed investment decisions. Fortunately, there are financial advisors who specialize in investment planning and can provide valuable guidance. We have compiled a list of the eight best financial advisors for investment planning to assist you in selecting the right one for your needs.

These advisors have been chosen based on their experience, knowledge, and reputation. They are all committed to helping their clients achieve their financial goals through personalized advice and strategies. Whether you are an experienced investor or just starting, these advisors can help you navigate the investment landscape.

Investment planning is a crucial aspect of financial planning, and it is essential to work with an advisor who can help you create a solid plan that aligns with your financial goals. By working with one of the eight best financial advisors for investment planning, you can gain the confidence and knowledge you need to make informed investment decisions.

In conclusion, selecting the right financial advisor for investment planning is crucial to achieving your financial goals. By working with one of the eight best financial advisors, you can benefit from their expertise and experience to create a personalized investment plan that aligns with your goals. Don’t hesitate to reach out to one of these advisors to take the first step toward securing your financial future.