10 Best Ways To Find The Cheapest Car Insurance Rates

Car insurance is a necessary expense for most drivers, but that doesn’t mean you have to pay a fortune to stay covered on the road. If you’re looking for ways to save money on your car insurance, you’re in luck. In this article, we’ll explore the 10 best ways to find the cheapest car insurance rates without sacrificing the coverage you need.

From shopping around for quotes to taking advantage of discounts and adjusting your coverage limits, there are plenty of strategies you can use to lower your car insurance costs. So, whether you’re a seasoned driver or a new driver just starting out, read on to discover the top tips for finding affordable car insurance rates that fit your budget.

- Shop around and compare rates from different insurance companies.

- Bundle your car insurance with other insurance policies, such as home or renters insurance.

- Increase your deductible to lower your premium.

- Drive a car that is less expensive to insure.

- Take advantage of discounts for good driving habits or safety features on your car.

- Pay your premium in full instead of monthly to avoid extra fees.

- Maintain a good credit score to qualify for lower rates.

- Consider usage-based insurance if you don’t drive often or have a short commute.

- Ask about discounts for affiliations with certain organizations or professions like AAA.

- Review your policy regularly and make adjustments as needed.

By following these tips, you can find the cheapest car insurance rates that fit your budget and provide the coverage you need.

10 Best Ways to Find the Cheapest Car Insurance Rates

Finding affordable car insurance rates can be a daunting task. With so many options available, it’s easy to get overwhelmed and end up paying more than you need to. In this post, we’ll take a look at the ten best ways to find the cheapest car insurance rates.

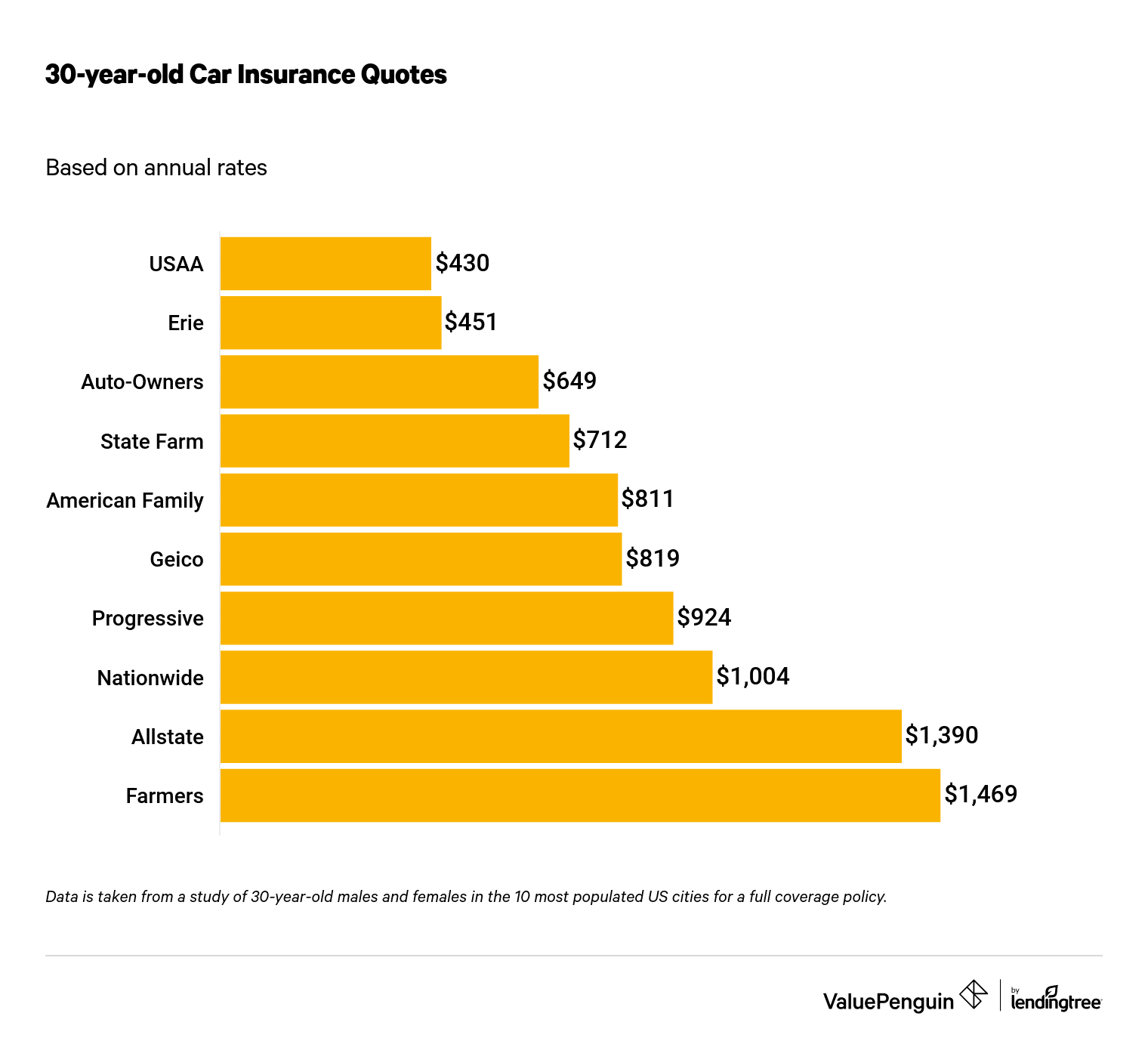

1. Shop around and compare rates

Why We Like It: Shopping around and comparing rates gives you a better understanding of the different insurance options available to you. It helps you to identify the best deals and discounts that can save you money in the long run.

Who Should Get It: Anyone who wants to save money on car insurance rates should shop around and compare rates. This is particularly important for drivers who are considered high-risk, as they may need to pay higher premiums.

- Compare rates from multiple insurance providers

- Look for discounts and deals such as multi-car, safe driver, and good student discounts

- Consider the level of coverage you need and adjust your deductible accordingly

- Pros:

- Can save you money on car insurance rates

- Helps you to identify the best deals and discounts

- Gives you a better understanding of the different insurance options available

- Cons:

- Can be time-consuming

- May require you to provide personal information to multiple insurance providers

2. Increase your deductible

Why We Like It: Increasing your deductible can significantly lower your car insurance rates. This is because you’re taking on more of the financial risk in the event of an accident, so the insurance company doesn’t need to charge you as much for coverage.

Who Should Get It: Drivers who have a good driving record and are comfortable taking on more financial risk in the event of an accident should consider increasing their deductible.

- Lower your monthly premium

- Can save you hundreds of dollars per year on car insurance rates

- Encourages safe driving habits

- Pros:

- Can significantly lower your car insurance rates

- Encourages safe driving habits

- Cons:

- You’ll pay more out of pocket in the event of an accident

- May not be a good option for drivers who are considered high-risk

3. Bundle your insurance policies

Why We Like It: Bundling your insurance policies can save you money on car insurance rates, as well as other types of insurance such as home or renters insurance. Insurance companies often offer discounts for bundling multiple policies together.

Who Should Get It: Anyone who has multiple insurance policies or is in the market for multiple insurance policies should consider bundling. This is particularly beneficial for families or individuals who own multiple vehicles or properties.

- Save money on car insurance rates as well as other types of insurance

- Easier to manage multiple insurance policies

- May qualify for additional discounts

- Pros:

- Can save you money on car insurance rates as well as other types of insurance

- Easier to manage multiple insurance policies

- May qualify for additional discounts

- Cons:

- May not be the best option for individuals who only need car insurance

- May require you to switch insurance providers

4. Maintain a good credit score

Why We Like It: Maintaining a good credit score can help you to qualify for lower car insurance rates. Insurance companies often use credit scores as a factor when determining rates, as individuals with higher credit scores are generally considered to be less risky to insure.

Who Should Get It: Anyone who wants to qualify for lower car insurance rates should maintain a good credit score. This is particularly important for individuals who have a history of missed payments or low credit scores.

- Qualify for lower car insurance rates

- May also qualify for better interest rates on loans and credit cards

- Encourages responsible financial habits

- Pros:

- Qualify for lower car insurance rates

- May also qualify for better interest rates on loans and credit cards

- Encourages responsible financial habits

- Cons:

- May take time to improve credit score

- May not be a good option for individuals with a history of missed payments or low credit scores

5. Drive a safe car

Why We Like It: Driving a safe car can help you to qualify for lower car insurance rates. Cars that are equipped with safety features such as airbags, anti-lock brakes, and backup cameras are generally considered to be less risky to insure.

Who Should Get It: Anyone who wants to save money on car insurance rates should consider driving a safe car. This is particularly important for individuals who are considered high-risk, as they may need to pay higher premiums.

- Qualify for lower car insurance rates

- May also reduce the likelihood of accidents and injuries

- Encourages safe driving habits

- Pros:

- Qualify for lower car insurance rates

- May also reduce the likelihood of accidents and injuries

- Encourages safe driving habits

- Cons:

- May require you to purchase a new car

- May not be a good option for individuals who cannot afford a new car

6. Take a defensive driving course

Why We Like It: Taking a defensive driving course can help you to qualify for lower car insurance rates. These courses teach you how to avoid accidents and drive safely, which can reduce the likelihood of accidents and injuries.

Who Should Get It: Anyone who wants to save money on car insurance rates should consider taking a defensive driving course. This is particularly important for individuals who are considered high-risk, as they may need to pay higher premiums.

- Qualify for lower car insurance rates

- May also reduce the likelihood of accidents and injuries

- Encourages safe driving habits

- Pros:

- Qualify for lower car insurance rates

- May also reduce the likelihood of accidents and injuries

- Encourages safe driving habits

- Cons:

- May require you to take time off work to attend a course

- May require you to pay for the course upfront

7. Ask about low-mileage discounts

Why We Like It: Asking about low-mileage discounts can help you to save money on car insurance rates if you don’t drive very often. Insurance companies often offer discounts to individuals who drive less than a certain number of miles per year.

Who Should Get It: Anyone who drives less than the average number of miles per year should ask about low-mileage discounts. This is particularly beneficial for individuals who live in urban areas and rely on public transportation or walking to get around.

- Qualify for lower car insurance rates

- May also encourage alternative modes of transportation

- May reduce wear and tear on your vehicle

- Pros:

- Qualify for lower car insurance rates

- May also encourage alternative modes of transportation

- May reduce wear and tear on your vehicle

- Cons:

- May not be a good option for individuals who rely heavily on their vehicle

- May require you to provide proof of low mileage

8. Consider usage-based insurance

Why We Like It: Usage-based insurance is a type of car insurance that charges you based on how much you use your vehicle. This can help you to save money on car insurance rates if you don’t drive very often or if you drive very safely.

Who Should Get It: Anyone who drives less than the average number of miles per year or who drives very safely should consider usage-based insurance. This is particularly beneficial for individuals who live in urban areas and rely on public transportation or walking to get around.

- Qualify for lower car insurance rates

- May also encourage safe driving habits

- May reduce wear and tear on your vehicle

- Pros:

- Qualify for lower car insurance rates

- May also encourage safe driving habits

- May reduce wear and tear on your vehicle

- Cons:

- May not be a good option for individuals who rely heavily on their vehicle

- May require you to install a telematics device in your vehicle

9. Choose a higher-rated insurance company

Why We Like It: Choosing a higher-rated insurance company can help ensure that you’re getting the best coverage and customer service. Higher-rated insurance companies are generally more reliable and have fewer customer complaints.

Who Should Get It: Anyone who wants to ensure that they’re getting the best car insurance coverage and customer service should choose a higher-rated insurance company. This is particularly important for individuals who have had negative experiences with their current insurance provider.

- Get the best car insurance coverage and customer service

- May also qualify for discounts and better deals

- May have fewer customer complaints

- Pros:

- Get the best car insurance coverage and customer service

- May also qualify for discounts and better deals

- May have fewer customer complaints

- Cons:

- May be more expensive than other insurance providers

- May require you to switch insurance providers

10. Ask about discounts

Why We Like It: Asking about discounts can help you to save money on car insurance rates. Insurance companies often offer discounts for a variety of reasons, such as being a safe driver, having multiple vehicles, or being a student.

Who Should Get It: Anyone who wants to save money on car insurance rates should ask about discounts. This is particularly important for individuals who are considered high-risk, as they may need to pay higher premiums.

- Qualify for lower car insurance rates

- May also encourage safe driving habits

- May reduce wear and tear on your vehicle

- Pros:

- Qualify for lower car insurance rates

- May also encourage safe driving habits

- May reduce wear and tear on your vehicle

- Cons:

- May not be eligible for certain discounts

- May require you to provide proof of eligibility

Frequently Asked Questions

In this section, we will answer some of the most common questions about finding the cheapest car insurance rates.

What is the best way to find the cheapest car insurance rates?

The best way to find the cheapest car insurance rates is to shop around and compare quotes from different insurance companies. You can do this online or by calling insurance companies directly. You should also consider bundling your car insurance with other types of insurance, such as home insurance, to get a discount.

Another way to find the cheapest car insurance rates is to increase your deductible. A higher deductible means you will pay more out of pocket if you get into an accident, but it also means you will have lower monthly premiums.

What factors affect car insurance rates?

There are several factors that can affect car insurance rates, including your age, driving record, the type of car you drive, and where you live. Younger drivers and those with a poor driving record are typically charged higher rates than older drivers with a clean driving record. Sports cars and luxury cars also tend to have higher insurance rates than economy cars. Your location can also play a role, as some areas have higher rates of car theft and accidents.

Other factors that can affect car insurance rates include your credit score and the amount of coverage you choose. If you have a low credit score, you may be charged higher rates. Choosing a higher level of coverage can also result in higher premiums.

Can I lower my car insurance rates by taking a defensive driving course?

Yes, you may be able to lower your car insurance rates by taking a defensive driving course. Many insurance companies offer discounts to drivers who complete an approved defensive driving course. These courses can teach you safe driving techniques and help you avoid accidents, which can result in lower insurance rates.

Before signing up for a defensive driving course, check with your insurance company to make sure they offer a discount for completing the course. You should also make sure the course is approved by your state’s Department of Motor Vehicles.

What is the difference between liability and full coverage car insurance?

Liability car insurance covers damages and injuries you may cause to other people in an accident. It does not cover damage to your own vehicle. Full coverage car insurance, on the other hand, includes liability coverage as well as coverage for damage to your own vehicle. Full coverage insurance typically includes collision coverage, which covers damage to your car if you are in an accident, and comprehensive coverage, which covers damage to your car from other sources, such as theft, vandalism, or weather-related events.

Full coverage car insurance is typically more expensive than liability insurance, but it provides more comprehensive protection for your vehicle.

What other ways can I save money on car insurance?

In addition to shopping around for the best rates and increasing your deductible, there are several other ways you can save money on car insurance. One way is to maintain a good driving record. Drivers with a clean driving record are often eligible for lower rates. You can also ask about discounts for things like being a safe driver, having multiple cars or policies with the same insurer, or having safety features on your car.

If you have an older car, you may want to consider dropping collision and comprehensive coverage, as the value of your car may not be worth the cost of the insurance. Finally, consider paying your premium in full or setting up automatic payments, as some insurers offer discounts for these payment methods.

In today’s world, car insurance is a must-have for every vehicle owner. However, finding the cheapest car insurance rates can be a daunting task. With so many options available in the market, it can be overwhelming to choose the right one. But don’t worry, we’ve got you covered. Here are the top 10 best ways to find the cheapest car insurance rates.

Firstly, it’s important to do your research. Shop around and compare different insurance providers. This will help you get a better understanding of the rates and coverage options available to you.

Secondly, consider increasing your deductible. A higher deductible can lower your monthly premium, but keep in mind that it also means you’ll have to pay more out of pocket in case of an accident.

Finally, take advantage of discounts. Many insurance providers offer discounts for things like safe driving, multiple policies, and bundling with other insurance types. Make sure to ask your provider about these discounts to see if you qualify.

In conclusion, finding the cheapest car insurance rates may take some time and effort, but it’s worth it in the long run. By doing your research, increasing your deductible, and taking advantage of discounts, you’ll be able to save money while still getting the coverage you need. Happy driving!